Nuclear’s Hitchhiker - Cameco Corporation (TSX:CCO | NYSE:CCJ)

Contributing Author: Dylan Rowe (dylanbrowe@gmail.com)

Source: The Bloomberg

Abstract:

As world leaders assign climate and carbon emission reduction goals in each of their countries, technologies required to meet these goals are narrowed down to a few options. The best of which, nuclear, provides sustainable, consistent, and carbon-free energy that has proven to be the most suitable option for countries to adopt to address their climate goals. Cameco Corporation out of Saskatchewan, Canada is best positioned in this energy transition. Cameco’s mining operations produce some of the highest-grade uranium in the world and have the resources to address the growing nuclear fuel demand, outstripping the existing supply. Cameco is also engaged in developing new technologies to make the mining of uranium more cost-effective and efficient, as well as interests in developing Small Modular Reactors (SMRs). In anticipation of Cameco’s significant growth opportunity, we arrive at a gross valuation of Cdn$52.77, implying a 62% upside from Cameco’s current share price.

Nuclear & World Energy:

Nuclear Energy:

Nuclear energy is created through two processes. The first and most widely used form in commercial practices is nuclear fission. Fission involves splitting atoms, which in a chain reaction produces a high amount of heat that turns a turbine through the emission of steam. The other process, nuclear fusion, involves the combining of atomic nuclei to produce heat; however, this form of power is not used in commercial practices because often the energy required to merge the atomic nuclei is greater than the actual energy produced [1]. Nuclear energy releases no carbon emissions.

World Energy State & Nuclear’s Place:

According to World-Nuclear.org, “electricity demand is increasing about twice as fast as overall energy use and is likely to rise by more than half to 2040.” Also, according to this source, nuclear power currently provides 10% of the world’s electricity and 18% in OECD (Organization for Economic Co-Operation and Development) countries, and “almost all reports on future energy supply from major organizations suggest an increasing role for nuclear power as an environmentally benign way of providing reliable electricity on a large scale” [2]. The OECD includes 38 member countries like the United States, Israel, and Japan [3].

As more developed countries outline goals to cut carbon emissions, such as the United States announcing they would like to cut emissions 50-52% from 2005 levels in 2030 [4], the attraction to nuclear energy as a reliable, effective, and carbon-free energy source increases. The EIA (U.S. Energy Information Administration) reports that “U.S. nuclear electricity generation capacity peaked in 2012 at about 102,000 MW when there were 104 operating nuclear reactors.” Currently, “there [are] 93 operating reactors with a combined generation capacity of about 95,492 MW” [5]. Although the number of reactors in the United States has decreased in the past decade, and Germany has recently decommissioned its last nuclear reactors [6], the United Nations reports that “as of 2021, 32 countries worldwide are operating 443 nuclear reactors for electricity generation and 55 new nuclear power plants are under construction” [7].

Nuclear power in these countries varies in levels of share of total electricity, with countries such as France leading the world with roughly 70% of their electricity coming from nuclear. The United States produces about 19% of its energy from nuclear, and China is close to 5%. Nuclear generation has rapidly increased in China in the past two decades, to current levels of 407 TWh, up over 25,000% since 1993. Levels in the United States have leveled out in this period. Still, we expect in the next decade for levels to rise once again as the need for nuclear power to achieve the country’s carbon emission reduction goals is realized. The US, however, produced almost twice what China output in 2021, despite production levels remaining relatively constant for the past two decades [8].

Uranium Market Imbalance:

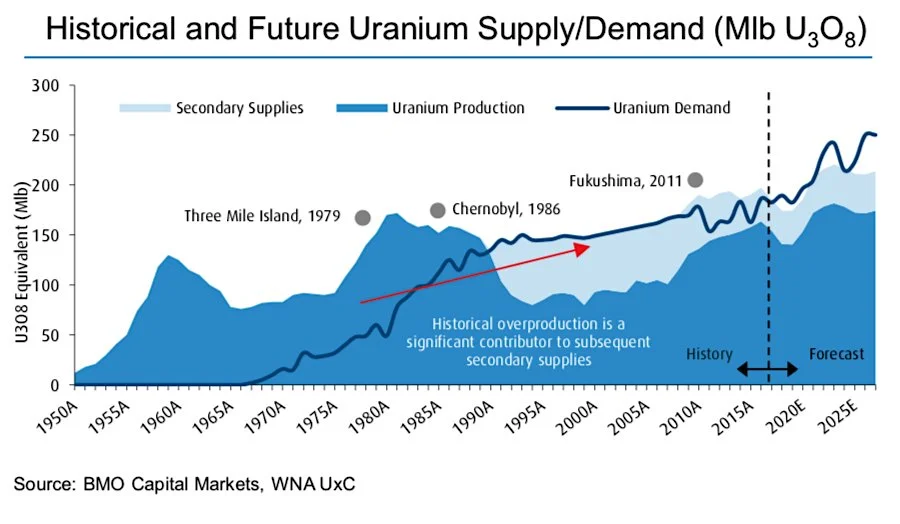

In June of 2021, Grant’s Interest Rate Observer released a report on the uranium industry and the imbalance between current stock supply and industry demand. “This year the world will consume 178 million pounds of uranium, according to research boutique UxC, but miners will extract only 166 million pounds of that radioactive haul from the earth.” According to the World Nuclear Association, there are 50 estimated reactors under construction (close to the United Nations’ estimates). “Bearing in mind the estimated remaining life of the world’s major mines, one can imagine the supply-demand imbalance becoming acute over the next seven years.” Quoted in Grant’s report was Marcelo Lopez, a portfolio manager at L2 Capital Partners, who speculated that uranium miners (including Cameco) would need a price per pound of around $60 to start addressing the supply/demand imbalance [9]. This price is almost 74% above Cameco’s year-end uranium realization price calculated by Bloomberg.

[10]

Cameco:

Background & Business:

For the past three decades, Cameco has engaged in the mining and refining of uranium to be turned to nuclear fuel at a later time. Also, Cameco engages in uranium fuel manufacturing where their enriched uranium (UO៴2) is pressed into pellet form and heated at a high temperature where it will later be shipped in steel tubes to be used as fuel for nuclear reactors [11,12].

Most of Cameco’s revenue is generated from uranium mining; however, fuel services are currently the only gross profit positive division. Due to Covid-19 and Canada’s Covid guidelines, Cameco’s mining division has taken a large hit over the past two years, with significant profitability in 2019. We and Cameco’s management believe that profitability will return to normal levels in the coming years as Covid restrictions decrease and the demand/market price for uranium increases.

Tier 1 Assets & Market Share:

Source: The Bloomberg

Source: The Bloomberg

Source: The Bloomberg

Cameco has three primary “Tier 1” Assets. These include the McArthur River Uranium Mine and Cigar Lake Uranium Mine in Saskatchewan, Canada, and the Inkai Uranium Deposit in Kazakhstan.

Source: Company reports

With high ownership stakes in each of their Tier 1 sites (70% at McArthur, 50% at Cigar Lake, and 40% at Inkai), Cameco is well positioned to take advantage of higher uranium prices at their highest uranium grade sites in their portfolio. Cameco’s Tier 1 assets have a combined 463.7 million pounds of uranium concentrate, which, with a future uranium price estimated by Marcelo Lopez in the Grant’s Interest Rate Observer Report, has an estimated value of $1.5 billion. This is compared to an estimated present value, with last year's realized uranium price of $34.58, of about $0.8 billion. These total values for Cameco don’t even consider some of Cameco’s smaller assets in the United States and Australia.

Uranium Supply Conservatism:

Because uranium is usually traded in long-term contracts (uranium needs time to be mined, refined, converted, etc.), the uranium spot market is highly illiquid. Cameco engages in high supply discipline in their mines to mitigate the risk of oversupplying the current market. For example, Cameco’s assets operated 75% below their productive capacity. Cameco has planned not to raise their capacity until 2024, where they will operate 40% below productive capacity. “…Since 2016, [Cameco has] left almost 115 million pounds of uranium in the ground through [their] supply curtailment activities.” Cameco has also purchased over 55 million pounds of uranium in the spot market and decreased their inventory by almost 20 million pounds in 2018. Altogether, Cameco has pulled roughly 190 million pounds of uranium from the market [12]. Cameco’s uranium supply discipline will keep it from depressing the market and worldwide price for uranium, both helping to protect their earnings and fostering a better market for prices to reach the target of $60/pound.

Global Laser Enrichment LLC (GLE):

Cameco is the project leader for an associated entity called Global Laser Enrichment LLC (GLE). “GLE is testing a third-generation enrichment technology that, if successful, will use lasers to:”

“re-enrich depleted uranium tails left over as a by-product, aiding in the responsible clean-up of enrichment facilities no longer in operation”

“produce high-assay low-enriched uranium (HALEU), the primary fuel stock for the majority of small modular reactors and advanced reactor designs proceeding through development”

and “produce low-enriched uranium for the world’s existing and future fleet of large-scale light-water reactors”

Cameco increased their stake in GLE from 24% to 49% in 2021 but has the option to increase their ownership to 75% to become the majority shareholder. Silex Systems Limited, an Australian technology company whose main asset is their laser technology, owns the other 51% stake in GLE [13].

Equity Interests in Developing Small Modular Reactors (SMRs):

Small modular reactors are, in its most basic form, a scaled-down version of existing light water nuclear reactors. However, because of their substantial decrease in size, the reactors need less safety shielding and less intensive safety procedures. SMRs also drastically reduce the cost of building a nuclear reactor, thus increasing lenders' willingness to finance reactor projects, and can be perfectly suited for areas that may not consume as much power as a full-size nuclear reactor would provide. Also, SMRs are meant to be complementary to other clean energy sources, such as wind and solar, and are meant to replace existing coal and fossil fuel plants [14].

Cameco has ownership interests to participate in developing these SMRs. In September of 2021, Cameco announced alongside GE Hitachi Nuclear Energy, GEH SMR Technologies, and Synthos Green Energy to “evaluate the potential establishment of a uranium fuel supply chain in Canada capable of serving a potential fleet of… small modular reactors in Poland.” In July of 2021, Cameco, GEH, and Global Nuclear Fuel-Americas “agreed to explore several areas of cooperation to advance the commercialization and deployment of… SMRs in Canada and around the world” [15;17]. Cameco has also signed a similar agreement with X-energy to deploy similar SMRs in Canada and the United States. X-energy was awarded by the United States Department of Energy roughly US$1.23 billion through the Advanced Reactor Demonstration program to build a commercial-size nuclear reactor by 2027 [16].

Risks:

Historical Profitability & Recent Earnings Decline:

Since 2015, Cameco’s revenue has decreased yearly to a total of about 46%. This calculation does include, however, the negative effects of the Covid-19 pandemic forcing Cameco to temporarily suspend operations. Even before Covid-19, the total decrease in revenue to fiscal 2019 was 32%. During these periods (FY15 to FY21 and FY15 to FY19), earnings before interest, taxes, depreciation, and amortization (EBITDA) have decreased almost 92% and 39%, respectively. Cameco’s gross profit of Cdn$1.9 million (down almost 100% since FY15) in the fiscal year 2021 was due to the increased costs associated with implementing certain Covid-19 protocols and the temporary shutdown of some Tier 1 assets. (Although Cameco’s revenue decreased each year between fiscal year 2015 and fiscal year 2021, free cash flow (calculated as Cameco’s cash from operations less capital expenditures) increased 1,363% and cash from operations increased 10%). Although we do not expect this historical earnings trend to continue due to the expected demand increase for Cameco’s uranium and higher uranium spot and long-term contract prices, there is still the chance this trend could continue into the future.

Cameco’s Dividends:

In 2021, Cameco’s board approved a Cdn$0.08 dividend per common share, representing a total dividend payment of Cdn$31.9 million. Cameco has paid a yearly Cdn$0.08 dividend since 2018 and plans to pay a Cdn$0.12 in fiscal 2022. The board of directors approved a 50% higher dividend due to “improving fundamentals for [Cameco’s] business, a growing contract portfolio, and [Cameco’s] decision to prepare McArthur River/Key Lake to be operationally ready,” which would lead to higher earnings and cash flow. We are concerned that this payment, though only slightly over 2% of Cameco’s revenue, is unnecessary, considering the payment was almost 17 times 2021 gross profits and 64% of EBITDA. We believe it wiser to use this capital to complete an equity buyback or simply leave it as cash or short-term securities on their balance sheet. If Cameco’s earnings were more mature and less volatile (since 2011, the year-over-year change in revenue has had a standard deviation of 15%), then we would not be as concerned with a yearly dividend.

Geopolitical Instability in Kazakhstan:

Because Kazakhstan is a developing country, it has a much higher probability of “social, economic, political, legal and fiscal instability.” In early 2022, Kazakhstan saw “the most significant political instability since it became independent in 1991.” Because of the instability, the government declared a state of emergency across the country but was able to regain control and tame the situation by the end of January. Cameco’s Tier 1 Asset, the Inkai Uranium Deposit, is positioned in a very high-risk geopolitical country which could result in a major loss of Cameco’s largest Tier 1 asset by reserves. Also, the Inkai mine is co-owned with Kazatomprom; a majority government-owned corporation which means that direct government instability could result in complications with Cameco accessing the mine and extracting uranium from it to sell.

Off-Balance Sheet Arrangements:

In their 2021 annual report, Cameco listed three types of off-balance sheet arrangements: purchase commitments, financial assurances, and “other arrangements.” Purchase commitments are long-term contracts associated with the purchase of uranium and fuel services. This totaled Cdn$864 million. Financial assurances mainly consist of “standby letters of credit and surety bonds... to provide financial assurance for the decommissioning and reclamation of [Cameco’s] mining and conversion facilities as well as… obligations relating to the CRA dispute.” (The CRA (Canada Revenue Agency) dispute started in 2008 when the CRA disputed Cameco’s marketing and trading structure/methodologies. Some disputed tax years before 2008 have since been resolved in Cameco’s favor, but some tax years past 2007 are still in question.) Financial assurances totaled Cdn$1.6 billion. “Other arrangements” are loan facilities that give Cameco the option to borrow 2 million kgU of UF6 (uranium hexafluoride) conversion services and 2.3 million pounds of uranium concentrate from 2020 to 2023. Repayment would be at the end of December 2023. We estimate the total value of these off-balance arrangements to be around Cdn$2.7 billion.

Traveling Wave Reactor Technology:

One of the newest innovations in nuclear reactor technology is the traveling wave reactor (TWR). Currently at the forefront of TWR technology is a company called TerraPower that has funding and oversight from Bill Gates. TerraPower’s TWR “[operates] at low pressure eliminating the risk of any high pressure or phase change-driven release of radioactivity, greatly reducing the cost of containment structures and the size of the emergency planning zone (EPZ) towards that of the plant footprint (1 km2).” The TWR is powered by spent, or depleted, uranium, which there is an enormous amount sitting across the world, such as in Paducah, Kentucky, where there is enough spent uranium to power the United States for more than a hundred years. The reactor would also be able to access a much higher yield of power from the uranium rods; 30% versus about 0.7% in traditional light water reactors. According to a Harvard Business School case study on TerraPower (for which the previous information is sourced), “TerraPower’s technology [has] the potential to either significantly reduce or altogether eliminate the need for uranium mining, uranium enrichment facilities, spent fuel reprocessing plants and spent fuel rod storage facilities, resulting in significant cost savings and enhanced safety and environmental benefits” [18]. Although we don’t believe that in the next one to two decades every single operating nuclear reactor will be replaced by TWR technology, the risk it could pose for Cameco in the distant future is significant. As said in the case study, TWR technology could entirely wipe out the need for companies like Cameco to exist, as existing depleted uranium supplies and high longevity of the spent fuel mean no new supply requirements in the uranium market for a long period of time. Currently, we are not entirely concerned about this technology as no commercially operating TWR plant is in service, and not every existing reactor requiring Cameco’s product will be immediately replaced with TWR technology.

Valuation:

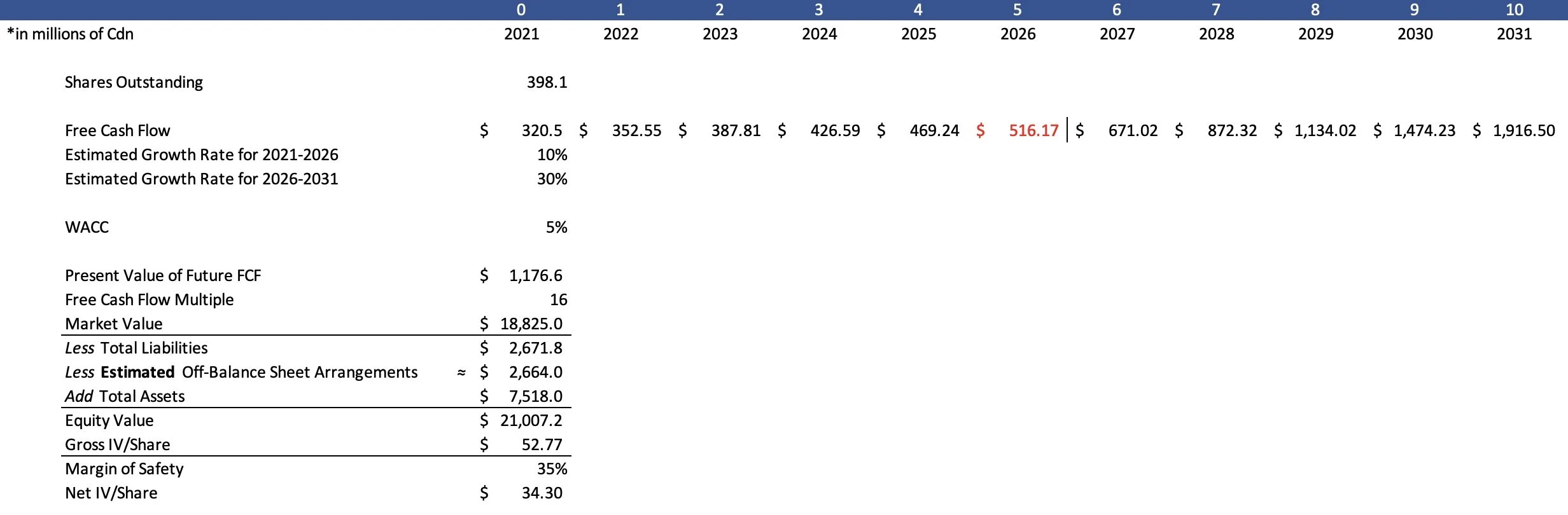

For our valuation, we used a discounted future free cash flow model with two speculated growth rates. We believe that Cameco’s FCF will compound at an annual rate until 2026 at 10%, and then 30% to 2031 (10 years ahead). The reason for these different rates is that we believe Cameco will still ease back into their pre-Covid earnings and that they will grow conservatively until around 2026. After 2026, we believe a combination of a potential price of uranium of $60/pound and a much higher demand for the metal to suffice, leading to a much higher compounding rate. To discount back to the present value, we assume a weighted average cost of capital of 5%, leading to a present value of the 2031 free cash flow of Cdn$1,176.6 million. We chose a 16x FCF multiple as a conservative value due to it being cheaper than the 5-year historical average of 18.6x. Taking off Cameco’s total liabilities and estimated off-balance sheet arrangements, and adding back their total assets, we arrive at a roughly Cdn$21 billion gross equity value (Cdn$52.77/share), a 62% premium to the current share price. Lastly, we apply a 35% margin of safety and get a final gross intrinsic value of Cdn$34.30, a 5% premium to the current share price.

Sources:

1 https://www.twi-global.com/technical-knowledge/faqs/nuclear-fusion-vs-fission#WhatIsFission

5 https://www.eia.gov/energyexplained/nuclear/us-nuclear-industry.php

6 https://www.commonsense.news/p/the-wests-green-delusions-empowered

7 https://www.un.org/en/global-issues/atomic-energy

8 https://ourworldindata.org/nuclear-energy

9 https://www.grantspub.com/archives/index.cfm - “More in Store”

10 https://capitalmarkets.bmo.com/en/#global-metals-and-mining

11 https://www.cameco.com/about

12 https://s3-us-west-2.amazonaws.com/assets-us-west-2/annual/cameco-2021-annual-report.pdf

13 https://www.gle-us.com/about-us/

14 https://www.wsj.com/articles/mini-nuclear-reactors-offer-promise-of-cheaper-clean-power-11613055608

17 https://www.cameco.com/media/news/cameco-ge-hitachi-and-global-nuclear-fuel-to-examine-potential-collaboratio

18 https://store.hbr.org/product/terrapower/813108?sku=813108-PDF-ENG