Farming Hydrogen from Wind – Orsted A/S (ORSTED DC)

Source: The Bloomberg

Abstract:

To meet net-zero goals, existing investments in easy to decarbonize industries, such as personal automobiles, need to be shifted to decarbonize hard-to-decarbonize industries, such as aviation, industrial manufacturing, and heavy transportation methods like cargo vessels and semi-trucks. An innovative way to address this problem is the use of green-hydrogen and e-fuels. Green hydrogen refers to hydrogen that was created not using any fossil fuels, and e-fuels refer to hydrocarbons comprised of green hydrogen and carbon sourced through atmospheric recycling, making it carbon neutral. Orsted A/S, a Danish corporation, is well situated to address a supply/demand imbalance in the market for green hydrogen. Historically specializing in offshore wind developments, Orsted has entered a new segment they call Power-to-X (P2X), which uses the clean energy from their offshore wind farms to create green-hydrogen. Orsted already has 10 contracts/partnerships for P2X, and they have the resources to become a much larger green hydrogen/e-fuel supplier in the future. Anticipating their ability to capture a material proportion of the total addressable market for green hydrogen/e-fuels in the next decade, we value Orsted at a gross valuation of Kr989.85 per share, a roughly 65% upside from Orsted’s current share price.

Introduction:

Source [1]

Today, much of the discussion on global decarbonization has been focused on industries that are relatively easy to decarbonize. Personal automobiles (i.e., sedans, SUV’s, et cetera) have been a great focus of decarbonization and with great success, as best seen in the rise of Tesla and legacy auto manufacturers starting to move production of vehicles to electric models, such as Ford. However, some of the highest emitters of carbon dioxide are the hardest to decarbonize. Roughly a quarter of global emissions come from the energy required by industrial manufacturing, such as iron and steel. 16.2% of global emissions come from the transportation sector [1]. According to the Environmental Protection Agency (EPA), of the total emissions by transportation in the United States, which makes up 14% of global emissions [2], 42% came from non-personal automobiles [3]. These types of vehicles, such as container ships and airplanes, are very difficult to decarbonize as existing alternative energy sources such as batteries don’t have enough energy density and are too heavy to maintain current flight paths and shipping routes without a recharging.

To meet world climate goals, we must find a solution to decarbonizing difficult-to-decarbonize industries.

Green Hydrogen & E-Fuels:

First, what is Hydrogen and E-Fuels?:

Hydrogen, the first element on the periodic table, is a single proton with a single electron and weighs about 1.01 atomic mass units. Due to its ability to undergo combustion reactions, hydrogen can serve as an energy efficient fuel, however due to its low volumetric-energy density, it does not make an efficient gas for very energy intensive projects.

Combined with carbon and oxygen, hydrogen can form hydrocarbons like oil and natural gas. Also, with carbon and oxygen, hydrogen can form alternative fuels such as methanol and kerosene, which is a common fuel in aviation.

There are three primary ways of producing molecular hydrogen. The most common way is through steam reforming of natural gas. This process is where, with a catalyst and steam, methane reacts under pressure to produce hydrogen, carbon monoxide, and carbon dioxide. This process makes up approximately 75% of the global hydrogen supply and emits an estimated 9 kilograms of carbon dioxide for every kilogram of hydrogen [5]. Not only does the process emit carbon as a product but is also extremely energy intensive. Producing 23% of hydrogen is coal gasification, a process where coal or other carbon-based raw materials are put into a high temperature and pressure system to convert the material into a synthesis gas (or syngas). Syngas, which is now composed of carbon monoxide and hydrogen, can further be transformed into hydrogen and carbon dioxide gas “…by adding steam and reacting over a catalyst in a water-gas-shift reactor” [6]. Coal gasification emits roughly 19 kilograms of carbon dioxide for every kilogram of hydrogen.

Only 2% of the worldwide molecular hydrogen supply comes from a process called electrolysis. Electrolysis is the process where energy is added to a system of water to dissociate the water molecules into hydrogen and oxygen. Because the dissociation of water is not spontaneous, the required energy to complete the process is high. To make 1 kilogram of hydrogen from electrolysis emits 14 kilograms of carbon dioxide and requires about 50 kilowatt hours of power, a higher carbon emissions value than steam reforming (75% of global supply) and slightly less than goal gasification (23% of global supply). The power used for electrolysis often comes from high carbon emitting fuel sources, such as natural gas and coal.

While conventional electrolysis with a traditional fuel source is a heavy carbon emitting process, the production of green hydrogen is not. Green hydrogen is produced using electrolysis powered by renewable energy sources, such as solar and wind power. According to S&P Global Commodity Insights, “with a basket of new tax credits for hydrogen and renewables with the US Inflation Reduction Act, analysts are projecting that subsidies could reduce the cost of green hydrogen to under $0/kg by 2030, which would rapidly accelerate the adoption of green hydrogen in the steel, transportation and power generation industries.” Currently, it is estimated that the cost to produce green hydrogen is around $4.38/kilogram. Subsidies for green hydrogen could stack up to around $4.50 per kilogram, meaning that producers are getting paid not only for selling green hydrogen but also for producing it [7].

E-fuels are fuels such as kerosene and methanol that are produced using hydrogen sourced from green hydrogen facilities. Because hydrogen gas is volumetrically inefficient, combining it with other elements to form greener hydrocarbons can make for a more efficient and more green fuel alternative for users of traditional fuels. Additionally, to make the fuel green, carbon is recycled from the atmosphere instead of being taken from other sources. Therefore, although e-fuels do emit carbon dioxide, e-fuels are carbon neutral [8].

Market for Hydrogen Gas and E-Fuels:

Of the aggregate volume of clean hydrogen projects announced, only 5% have reached final investment decision. Of the 70 million tonnes of clean hydrogen required to be produced annually to meet 2030 net zero goals (according to the IEA), less than 1 million tonnes are being produced, and all currently announced projects will only address 30 million of the 70 required for the net zero goals. In the United States alone, roughly half a trillion dollars of investment is required by 2050 for net zero goals.

For the remaining 40 million tonnes required (68 million if you only include locked-in investment production), the “IEA points to a combination of policy and regulatory uncertainty, high costs, lack of infrastructure to move hydrogen around and – underpinning it all – uncertain demand for the final product” [9].

Green hydrogen can be used to supply hard to decarbonize industries such as aviation and shipping (cargo vessels, trucks, and trains), which collectively emit 3.6% of global carbon emissions. Green hydrogen can also be used to decarbonize industrial and chemicals sectors. The chemical sector’s energy consumption emits roughly 3.6% of global emissions and emits 2.2% just in its production. The energy use for industrial production of iron and steel accounts for 7.2%. Altogether, green hydrogen can help to eliminate 16.6% of global carbon emissions

The current supply/demand imbalance of green hydrogen opens an opportunity for more firms to enter the market.

Orsted – Background:

Originally called Danish Oil and Natural Gas (DONG), Orsted was founded in 1973 to aid in Denmark’s energy security during the Arab-Israeli War (Yom Kippur War) where Arab members of OPEC imposed oil embargos on countries that supported Israel during the conflict. This caused oil prices to spike during this period, leading to energy hardships for countries not directly embargoed. To further aid in Denmark’s energy independence, the Danish government wanted to create a wind energy industry. In 1991, at 11 wind turbines, Vindeby was Orsted’s first offshore wind farm. Seven years later, another five 150 megawatt facilities were announced. 2008 marked a turning point for Orsted which now wanted to prioritize transforming from an oil and gas producer to a renewable energy developer. In 2017, Orsted officially became the new name of DONG Energy (“Energy” was added in 2006 as oil and gas no longer became the only energy product of the company), and the remaining oil and gas operations began to be divested [10 & 11].

Orsted – Business Segments:

Source: Orsted 2022 Annual Report, Pg. 11 | [15]

Source: Orsted 2022 Annual Report, Pg. 48 | [15]

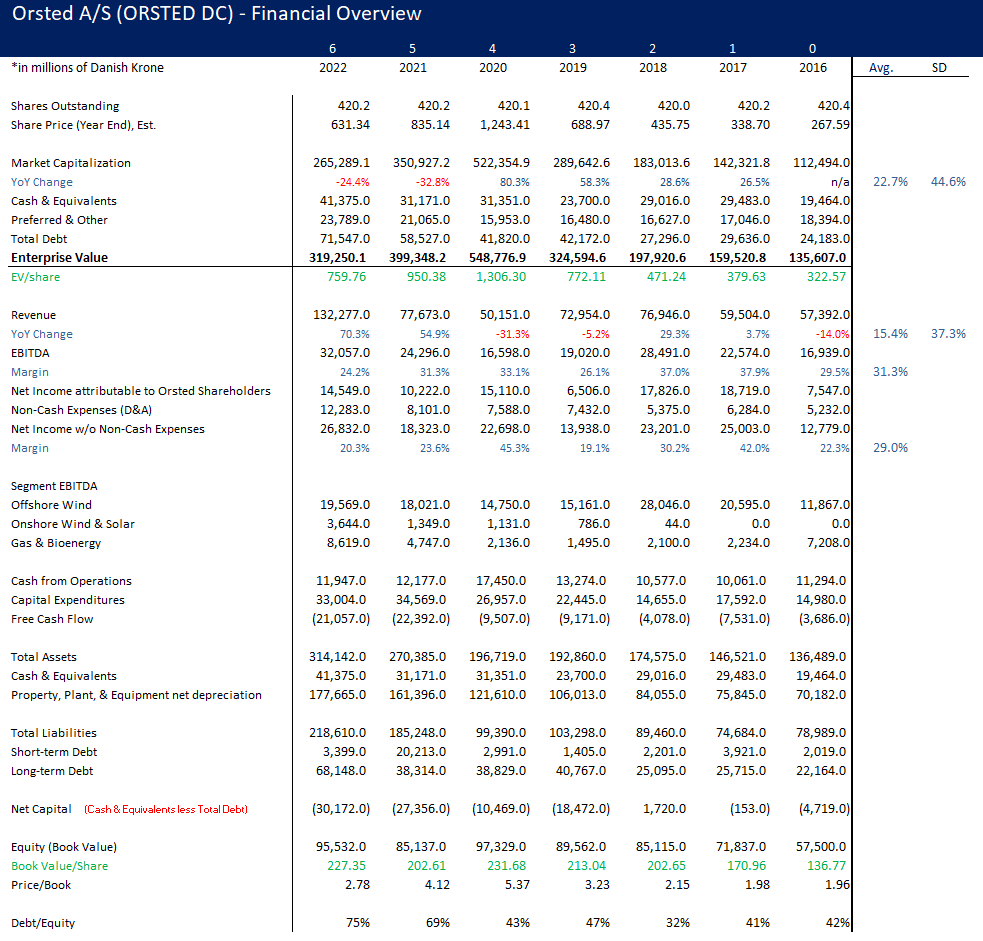

Source: The Bloomberg and Company Reports

Offshore Wind:

Orsted’s bread-and-butter is offshore wind farms, constituting 59% of installed energy capacity and 46% of production in 2022. Additionally, 62% of EBITDA was contributed by offshore wind, and Orsted holds a third of all existing offshore wind projects (excluding China). At the end of 2022, Orsted held 8.9 gigawatts of installed capacity, is currently developing 2.2GW, and was awarded 11.2GW, giving a total capacity of 22.2GW.

Earnings for offshore wind are generated through a variety of ways. The first is through the “sale of power” line item in Orsted’s financial statements which contributed Kr52.3bn in revenue out of offshore’s total revenue of Kr81.4bn. “Sale of power” is Orsted selling energy through contracts such as corporate power purchase agreements, which are long-term energy generation contracts. Next, Orsted sells power as a utility earning the segment Kr15.1bn. In 2022, Orsted sold power at an average Kr/MW of Kr919/MW, or about $88.55/MW. Orsted also earns revenue from the construction of offshore wind assets, which earned them Kr11.6bn in 2022, and from the operations and maintenance of assets, which earned them Kr2.4bn.

Orsted operates/develops two types of wind farms: fixed-bottom platforms and floating wind farms. Fixed-bottom platforms are the typical style of a wind farm that are embedded to the sea floor with fixed bases. Floating wind farms are attached to the sea floor using cables, enabling them to be placed in deeper waters whereas fixed-bottom farms need to be in more shallow locations [12].

Orsted’s largest fixed-bottom wind farm is its Hornsea location off the coast of the United Kingdom, which is also the largest operational wind farm in the world. Hornsea 1 and Hornsea 2 are currently operational, with a combined capacity of roughly 2.5 gigawatts. Orsted has also been awarded the construction of Hornsea 3, which will be the “single biggest offshore wind farm,” trumping Hornsea 2 with a capacity of 2.85GW alone [13, 14, & 15]. Additionally, Orsted is in the pre-application stage for a 4th project, Hornsea 4 [16].

While not operational yet, Orsted has partnerships in four countries to develop floating wind farms. In Scotland, Orsted has been awarded Project Stromar which will have an overall capacity of roughly 1 gigawatt. Also in Scotland, Orsted is currently developing a 100 megawatt farm called Project Salamander. South, in Spain, Orsted is partnering with Repsol to develop floating wind farms off the coast of the country, and in a similar deal in Norway, Orsted is partnering with Fred. Olsen Renewables and Hafslund Eco to develop the technology. Although not confirmed to contain floating wind farms, Orsted has entered a partnership in Korea with POSCO Group to develop offshore wind farms, “some of which are likely to be floating given Korea’s excellent conditions for floating offshore wind” [17, 18, 19, & 20].

Onshore Wind & Solar:

Complimenting Orsted’s specialty in developing offshore wind farms is its onshore wind division, as well as its onshore solar division. 28% of Orsted’s installed energy capacity comes from its onshore production and made up 37% of its 2022 energy production, however onshore production only constituted 11% of fiscal 2022 EBTIDA. At the end of 2022, Orsted had 4.2 gigawatts of installed capacity and 2.1 gigawatts of capacity in its development pipeline.

Earnings for onshore energy production is generated by two sources. The first is the generation of power as a utility provider which earned Kr2.1bn, constituting 99% of this segment’s revenue. The remaining balance is generated through operations and maintenance fees, which earned Kr31mn in 2022.

While this division is not the primary expertise of Orsted, it does have room to grow, especially in areas where they already have a presence. For example, in the Permian Basin where one of Beskar’s past researched companies, Texas Pacific Land Corporation (TPL), holds a significant amount of real estate, Orsted currently has one solar facility near their land and six wind facilities north of the oil basin. Based off our past research on TPL, we know that they have begun to expand, while still slowly, their renewable energy operations. This gives a great opportunity for Orsted to expand its power generation operations in the Permian Basin region, further expanding the use of the land for clean energy activities, and a great opportunity for TPL to attract more renewable power providers to their land, which continues to shift the company from a legacy oil and gas company to a modern clean energy company [21, 22, & 23].

TPL Surface Acreage

Source [22]: Texas Pacific Land Corporation Website

Orsted Renewable Holdings Near TPL Land

Source: The Bloomberg

Bioenergy & Gas:

The last of Orsted’s current operating divisions is its bioenergy and gas division, which remains from Orsted’s historical oil and gas business that it’s divesting. Both energy sources supply power to their combined heating and power plants, and the company had been required by the Danish state this past year to maintain operations on remaining coal fired plants to ensure Denmark was able to get through the past winter season with enough heat and power. This was due to a European energy crisis because of the ongoing Russo-Ukraine War that cut off energy supplies to Europe. Orsted expects to fully exit its coal operations by the end of this year.

To repurpose its legacy coal plants, Orsted has begun to convert the facilities to take in biomass energy. Although biomass energy releases carbon dioxide (still less than coal), it is a renewable fuel source, and the emitted carbon can be captured through direct carbon capture facilities. Orsted’s primary biomass is wood pellets, straw, and chips that can be regrown, making them renewable energy sources [24].

Orsted already has plans to complete carbon capture and storage at these power plants. At its Avedøre power station (which has a power-generating capacity of 806 megawatts and is one of Orsted’s largest) and Asnæs power station in Denmark, the Danish Energy Agency has awarded the company a “20-year contract for… carbon capture and storage” at the two stations. This captured carbon will then be shipped to Norway for storage in the North Sea. The contract “will capture and store 430,000 tonnes of biogenic CO2” [25].

Avedøre Power Plant

Asnæs Power Plant

Due to elevated energy prices in 2022, this segment made up 27% of Orsted’s EBITDA and 35% of its revenue. The primary revenue generation components for this segment are made up of the sale of gas and the generation of power as a utility provider. In fiscal 2022, Orsted generated Kr20.9bn just from selling gas, or around half of the total segment earnings. In generating power, Orsted earned Kr12.7bn. The remaining sources of earnings for this segment were the sale of power assets (Kr5.9bn), heat generation (Kr3.0bn), distributions (Kr277mn), and operations and maintenance (Kr733mn). Installed capacity from this segment makes up 14% of Orsted’s total capacity and generated 17% of Orsted’s total power generation in 2022.

Orsted – Power-to-X (P2X):

What is P2X and how does it work?:

In order to manufacture green hydrogen through electrolysis, there must be a source of clean energy to enable the process of splitting water into hydrogen and oxygen. P2X, or Power-to-X, is a new division of Orsted that aims to use its renewable energy assets, predominantly its offshore wind portfolio, to supply clean energy to create green hydrogen. Rather than using fossil fuels and coal to supply the energy of electrolysis, Orsted can make hydrogen completely green.

Using this green hydrogen, Orsted can also produce a variety of e-fuels, or hydrocarbons using green hydrogen, such as e-methanol and e-kerosene. While hydrocarbons do require carbon as an elemental component and release carbon dioxide into the atmosphere, Orsted can recycle carbon already in the atmosphere, meaning the use of e-fuels is carbon neutral.

Opportunities for P2X:

Because of the number of ways green hydrogen can be used to decarbonize hard to decarbonize industries, there are many opportunities for P2X to address. The production of e-methanol can supply power to container ships. The production of e-kerosene can supply power to airliners. E-ammonia can be used for industrial production or also as an alternative shipping fuel [26].

With a 70 million tonnes per year total addressable market for green hydrogen, and only 1 million tonnes currently being produced, Orsted is placed in a perfect position to help address the current supply/demand imbalance.

P2X - Existing Contracts:

Orsted currently has 10 commercial projects in its development pipeline for P2X, as well as personal projects that utilize green hydrogen supplied by P2X. While none of these projects are fully operational and none have earned any money yet, they still begin to position Orsted as a leader in advancing green hydrogen technology. [27]

1 - The Westküste 100 project (Germany) [28]:

Purpose: Industrial scale renewable hydrogen plant on Germany’s coast

Size: 30 megawatt electrolyzer

2 – Green Fuels for Denmark [29 & 30]:

Purpose: Repurpose the Avedøre power station into a carbon capture plant and green hydrogen/e-fuel production plant

Size: 1.3 gigawatt electrolyzer (by 2030)

3 - SeaH2Land Program (Netherlands) [31]:

Purpose: Supply green hydrogen to industrial energy demand in the Netherlands and Belgium

Size: 1 gigawatt electrolyzer

4 – Project Haddock (Netherlands) [32]:

Purpose: Partnership with the fertilizer company Yara to use green hydrogen to make cleaner ammonia

Size: 100 megawatts

5 – Gigastack Project (United Kingdom) [33]:

Purpose: Demonstrate how green hydrogen “derived from offshore wind can support the UK’s 2050 net-zero greenhouse gas emission target”

Size: 100 megawatts

6 – H2RES (Denmark) [34]:

Purpose: Orsted’s first renewable hydrogen project | Research & development effort to test using offshore wind to fuel electrolyzer

Size: 2 megawatts

7 – OYSTER [35]:

Purpose: Research & development project to test offshore wind connected to an offshore electrolyzer plant, and the transportation of green hydrogen offshore to onshore

8 – FlagshipONE (Sweden) [36]:

Purpose: Development of Europe’s largest e-methanol project to service e-methanol powered vessels

Size: 50,000 tonnes of e-methanol per year (starting in 2025)

9 – Project Star (United States) [27]:

Purpose: Partnership with container shipping company Maersk “to develop the world’s largest e-methanol facility for shipping… based on the US Gulf Coast” using onshore wind and solar

Size: 300,000 tonnes of e-methanol per year

10 – Idomlund Project (Denmark) [37]

Purpose: Partnership with Skovgaard Energy to develop a P2X facility in western Denmark powered by onshore wind and solar, and later offshore wind

Size: 150 megawatts and could increase to 3 gigawatts

Personal Project (11) – Orsted/ESVAGT [38]:

Orsted has signed agreements with service operation vessel (SOV) manufacturer and operator ESVAGT to lease e-methanol powered SOVs. These vessels are used to service Orsted’s offshore wind farms and to transport Orsted’s crew.

Source: ESVAGT

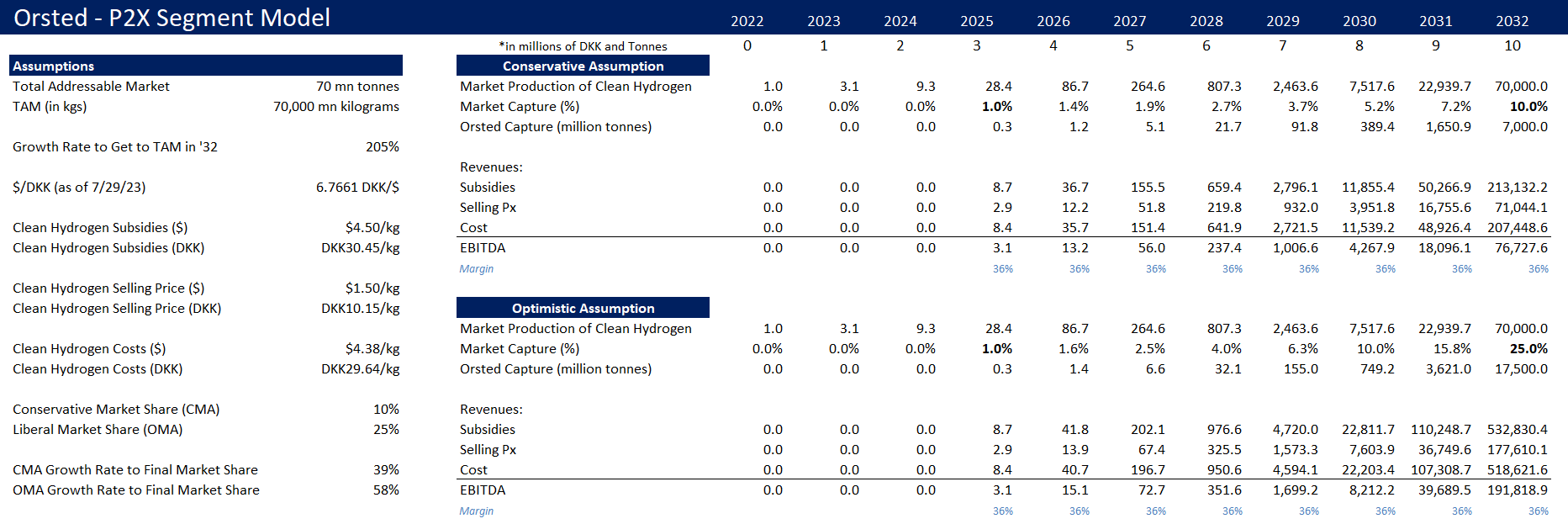

P2X – Segment Model

To create the model for P2X, I used the research report from S&P Global and an article from the Financial Times about the green hydrogen market. I assumed a total addressable market of 70 million tonnes of clean hydrogen as the end market production number in the model in 2032, two years later than the net-zero target of 2030 to allow for possible delays. I also created two scenarios of the market share Orsted could capture: a conservative market assumption (CMA) and an optimistic market assumption (OMA). The CMA had a capture number of 10% whereas the OMA had a capture number of 25%. The starting operational dates of some of Orsted’s green hydrogen projects was in 2025, so I input a 1% market share at their starting point for each assumption, and 0% for each year before 2025. To calculate the revenue of the segment, I multiplied a green hydrogen subsidy by Orsted’s production added with a conservative selling price per kilogram of Kr.29.64 ($1.50/kg) by the production number. The cost of green hydrogen was directly pulled from the S&P Global report. At the final yearly production number of 70 million tonnes, or 70 billion kilograms of green hydrogen, Orsted earns roughly Kr76bn at a low-end assumption and Kr192bn in a high-end assumption.

Orsted – Risks:

Unlike US-listed corporations which list multiple pages of risk factors in their businesses, Orsted has just two pages. Below is a list of quotes from these two pages I found concerning and contributed to my conservative margin of safety in my valuation.

Financial Market Risks

a. “However, we are exposed to inflation risk on projects with fixed nominal cash flows, as an increase in inflation will erode the expected real value of the revenue.”

b. “Based on our GBP exposure after hedges, a 10% decrease in the GBP/DKK exchange rate will result in a loss of DKK 1.4 billion over the period 2023-2027, all else remaining unchanged.”

Power Prices and Energy Markets

a. “We are also exposed to liquidity risks, as we are required to post collateral at exchanges if our [hedge] positions are ‘out of the money.’”

b. “Based on our power price exposure after hedges, a 10% decrease in the power price will result in a loss of DKK $4.0 billion over the period 2023-2027, all else remaining unchanged for our offshore and onshore assets.”

Aside from these risks specifically mentioned by Orsted, I was also concerned with Orsted’s decision to maintain a dividend payment to shareholders. On page 5 of their 2022 annual report, they mentioned how “[their] net debt increased to DKK 30.6 billion” and “the increase was mainly due to dividend payments of DKK 5.7 billion and higher lease obligations of DKK 1.6 billion, whereas [they] had neutral free cash flows.” This is very concerning to me. During ongoing operations (not including a merger or acquisition by another firm), if management wishes to issue a dividend, it should only be when the firm has enough excess free cash flow that they can afford to pay the dividend without issuing additional debt. This Kr5.7 bn (which was also an 8% increase from the previous year) should have been used for further capital investment, or continuing to strengthen the company’s balance sheet which already has a net capital amount (cash and equivalents less total debt) of negative Kr30bn. If the purpose of this dividend is to attract investment interest, management should seek other alternatives, such as selling more to the ESG benefits of the firm rather than paying a dividend it must issue debt for. We call on Orsted to immediately seize their dividend payment and continue to reinvest capital into the business and/or strengthen its balance sheet.

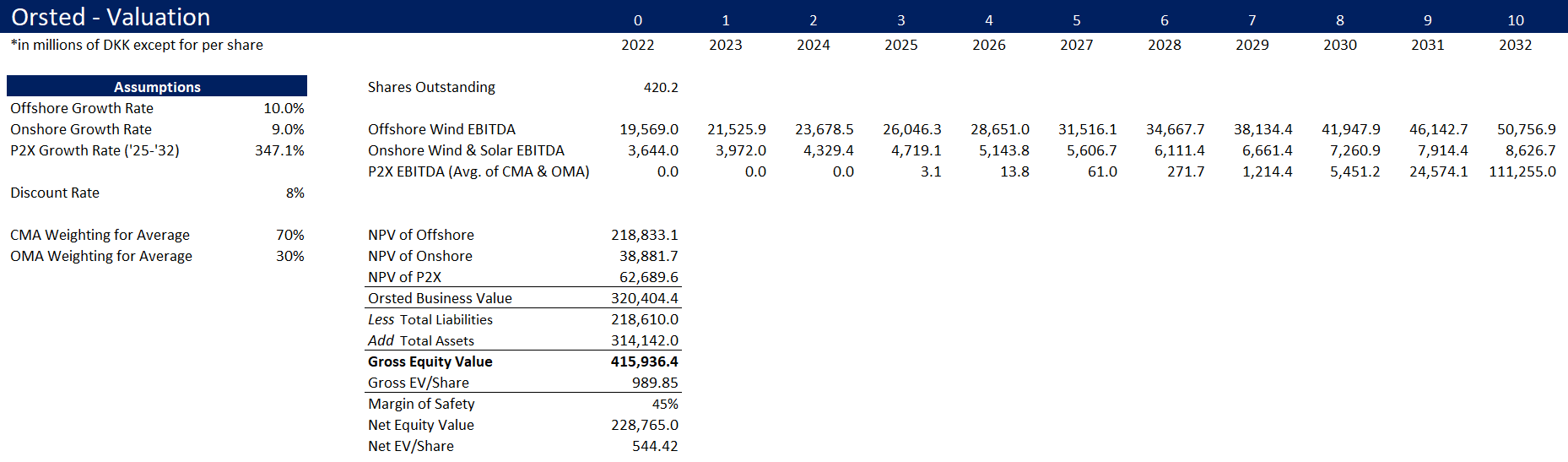

Orsted – Valuation:

To value Orsted, I used a net-present-value of EBITDA model for each of the three main segments relevant to an innovative clean energy study (meaning the earnings from the combined heating and gas plants were excluded). The discount rate used for the NPV was 8%, roughly 250 basis points higher than a 6-month US Treasury Bill, and 400 basis points higher than a US 10-year Treasury Bill for an extra conservative analysis. The EBITDA of the offshore and onshore wind/solar segments grew at 10% and 9%, respectively, and the growth rate for P2X was based off the growth from the P2X segment model. The EBITDA for P2X was a weighted average of the CMA and the OMA, with a 70% weighting towards the CMA and 30% towards the OMA. After the sum of all the NPVs, I added the total assets and subtracted the total liabilities to arrive at a gross equity value of Kr416bn, or Kr989.85 per share, representing about a 65% upside to the current share price. I then applied a conservative 45% margin of safety, bringing a net equity value of Kr229bn, or Kr544.42 per share, representing about a 9% discount to the current share price.

Sources:

[1] https://ourworldindata.org/emissions-by-sector

[2] https://www.statista.com/topics/3185/us-greenhouse-gas-emissions/#topicOverview

[3] https://www.epa.gov/greenvehicles/fast-facts-transportation-greenhouse-gas-emissions

[5] https://orsted.com/en/insights/white-papers/decarbonising-society-with-power-to-x

[6] https://netl.doe.gov/research/Coal/energy-systems/gasification/gasifipedia/intro-to-gasification

[9] https://www.ft.com/content/1d4e5402-a4af-4b0d-a478-293b96bc0f55

[10] https://orsted.com/en/who-we-are/our-purpose/about-our-name

[11] https://www.britannica.com/event/Arab-oil-embargo

[13] https://orsted.com/en/what-we-do/renewable-energy-solutions/offshore-wind

[14] https://hornseaproject3.co.uk/about-the-project

[16] https://hornseaprojects.co.uk/hornsea-project-four

[17] https://orsted.com/en/what-we-do/renewable-energy-solutions/floating-offshore-wind-energy

[18] https://orsted.com/en/what-we-do/renewable-energy-solutions/floating-offshore-wind-energy/projects

[19] https://orsted.com/en/media/newsroom/news/2022/04/20220405508011

[20] https://orsted.com/en/media/newsroom/news/2021/06/363524256672655

[22] https://www.texaspacific.com/assets/surface-acreage

[23] https://www.beskarresearch.com/research/k6mflpzw5hw6l0saa23jdrah4hasal

[24] https://orsted.com/en/what-we-do/renewable-energy-solutions/bioenergy

[25] https://orsted.com/en/what-we-do/renewable-energy-solutions/orsted-awarded-ccs-contract

[26] https://orsted.com/en/what-we-do/renewable-energy-solutions/power-to-x

[27] https://orsted.com/en/what-we-do/renewable-energy-solutions/power-to-x/our-projects

[28] https://orsted.com/en/media/newsroom/news/2020/08/855576841937376

[29] https://orsted.com/en/what-we-do/renewable-energy-solutions/power-to-x/green-fuels-for-denmark

[30] https://orsted.com/en/media/newsroom/news/2021/06/857452362384936

[31] https://orsted.com/en/media/newsroom/news/2021/03/451073134270788

[32] https://orsted.com/en/media/newsroom/news/2020/10/143404185982536

[34] https://orsted.com/en/media/newsroom/news/2021/05/953942245693267

[35] https://orsted.com/en/media/newsroom/news/2021/01/837698488913840

[36] https://orsted.com/en/media/newsroom/news/2023/05/13682622

[37] https://orsted.com/en/media/newsroom/news/2022/12/13665899