An Old Dog Can Learn New Tricks - Texas Pacific Land Corporation

Source: Bloomberg

Abstract:

Born out of the bankruptcy of the Texas and Pacific Railway, Texas Pacific Land Corporation (formerly Texas Pacific Land Trust) is one of the largest landowners in the state of Texas. As part of the restructuring, the land held by the company was transferred into a trust which now collects oil and gas royalties from operators who conduct fracking operations on their land. With over 880,000 acres in western Texas, TPL, along with other parties, has the opportunity to expand its renewable power operation and expand into other income generative fields, such as carbon capture technology and sustainable bitcoin mining. In a conservatively optimistic valuation of TPL, I arrive at a price target and valuation at about $694 per share.

Background:

Formed out of the bankruptcy of the Texas and Pacific Railway Corporation, Texas Pacific Land Corporation (then Texas Pacific Land Trust) has used its large tracts of land in western Texas for fracking purposes. Historically, the company has generated the majority of its revenue by charging oil and gas operators royalties on their well’s revenue. More recently, the company introduced a new subsidiary called Texas Pacific Water Resources which supplies water, crucial to the fracking formula, to its oil and gas customers.

Opportunity for TPL/Thesis:

With over 880,000 acres of land is west Texas, Texas Pacific Land Corporation (TPL) has several opportunities to engage in new income streams that are more compliant with ESG (Environmental, Social, and Governance) standards. They include:

“Next-Gen” Opportunities:

Since 2008 (except 2021, but we’ll discuss this later), TPL has classified “wind generation income” within its “surface related income” line item. Since 2019, solar power has also been included in the same line item. Interestingly, in the 2021 annual report, the Company says it “looks for new opportunities related to renewable energy, environmental sustainability, and technology, among others, that can leverage the already existing legacy surface and royalty assets.” Also, in TPL’s latest annual report, the inaugural ESG segments disclosed a partnership between TPL and some of its lessees designed to develop renewable energy projects and to advance “technologies that support emissions management.” The push to expand renewable projects, or a general shift towards other income streams, is also highlighted in a relatively new risk factor outlining the impact decarbonization efforts may have on the Company’s oil and gas royalty income.

Recently, I held a phone call with a member of TPL’s management (Shawn Amini, VP of Finance and Investor Relations) to discuss their renewable projects in detail, as there is very little shared in their annual reports. Some of the questions I posed included:

In TPL’s discussion of ESG on page 5 of the fiscal 2021 10K, there is mention of a discussion with current oil and gas lessees about developing renewable energy infrastructure. Would these developments/projects for things like wind and solar farms follow a similar income structure to the oil and gas division of royalties, or would TPL personally be involved in the co-funding/investing in these projects alongside the partners?

Where are existing renewable projects on your acreage located, how many total acres do they take up, and is income from these projects generated in royalty or lease form?

In the fiscal 2021 10K, in the notes to financial statements, page F-9, why are solar and wind income not mentioned under “Easements and Other Surface-Related Income?” This is a change from previous annual reports; for example, in fiscal 2020, “wind power [and] solar farms” are mentioned on page F-9 of the notes to financial statements and wind power income has been mentioned in every 10-k (excluding fiscal 2021) since 2008.

In response to the first question above, Mr. Amini explained that in keeping with TPL’s historical capital light business model, the partnerships with current oil and gas lessees would most likely be in lease form, but they would like to try and get royalty revenues in these projects when possible. However, Mr. Amini pointed out that because the profit margins on renewable projects are extremely slim, an expansion of renewable projects would be difficult.

For the second question, Mr. Amini explained that current renewable projects take up over a thousand acres (he did not give me a specific number) and that they are currently located on the Midland side of the Permian Basin. When asked about the form of income the renewable projects generate, Mr. Amini said that they are in royalty form, and flow through the income statement under Easements and Surface Related Income line item. I was also informed about a specific situation in which a wind farm located on TPL’s land in 2021, during the extreme winter storm in Texas where oil and gas operations grinded to a halt, made roughly $2 million in royalties because the farm was still operational, and the cost of energy skyrocketed.

For the last question above, related to the wording of the notes to financial statements, Mr. Amini explained to me that this wording change from previous years was not intentional, but purely a materiality item. He continued by saying that there are a few different streams of income in this line item, so they usually list the highest earners in the notes to financial statements. From this we can infer that a new or existing “roadway” project replaced solar and wind projects on the hierarchy of importance for Easements and other Surface Related Income.

Also, in the call with Mr. Amini, he mentioned that TPL has a team dedicated to finding “next-gen” opportunities for its business. Among the opportunities include: more renewable projects, bitcoin mining, and carbon capture projects. Bitcoin mining was mentioned twice on the call, at separate times, which is interesting considering the largest shareholder of TPL, Horizon Kinetics, features in its quarterly letters commentary on the advantages of Bitcoin as a hedge against inflation and monetary debasement. Murray Stahl, the CEO of Horizon Kinetics, is also a member of TPL’s Board of Directors. Towards the end of the call, Mr. Amini briefly discussed carbon sequestering projects, noting a study that was conducted on their soil to see how much carbon could be held in the grass. Hydrogen energy was also mentioned.

Balance Sheet Adjustment

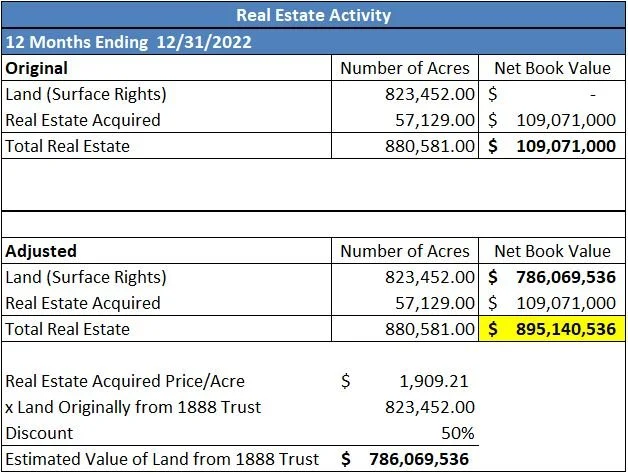

TPL, under their original 1888 trust formation, has no value assigned to the land it was granted in the trust. However, there is still value to this land based on the opportunities that could be implemented, such as renewable energy and carbon capture projects. Though TPL does not give a book value to the original land, they do assign value to the real estate they have acquired. To calculate the value of the original land, I took the price per acre of the real estate acquired by TPL, multiplied that value by the original land currently held, and applied a discount rate of 50%. In this calculation, I estimated a land value of roughly $786 million, bringing the total real estate value to about $895 million. This adjustment increased shareholders’ equity by 137% and brought the book value per share from $84.07 to $199.54.

Risks:

There are three main risks I see with TPL and the potential execution of an income stream change. The first is with the board of directors and their backgrounds strictly in the oil and gas industry. Only one director, Barbara Duganier, has a background in the renewable power industry. Little experience of the board in the renewable field could lead to a failed execution, or no execution at all, of changing revenue streams. Another risk is with the partnership between TPL and some of their oil and gas leeses. If the partnership falls apart, either by TPL pulling out or the operators pulling out, a plan to shift to renewables or projects like Bitcoin mining could fall apart. Lastly, dissension in the board could further affect the productive motion of implementing new renewables and sustainable Bitcoin mining efforts. This concern of mine stems from a letter filed in late April of 2019 from Dana McGinnis of Mission Advisors, LP, calling for the rejection of appointing Eric Oliver from SoftVest Advisors to TPL’s board of directors. Mr. Oliver was backed by the largest shareholder, Horizon Kinetics and Mr. McGinnis called to appoint Four-Star General Donald G. Cook to the board. Dissension could also in the future stem from some on the board wanting to innovate TPL’s business model while some want to stick with TPL’s legacy income.

Valuation:

Source: Bloomberg

Source: Bloomberg

Using a free cash flow basis for my valuation, I chose two cap rates (or multiples) for a “High End,” optimistic valuation, and a “Low End,” less optimistic valuation. The “optimism” is based on TPL’s ability to successfully execute a change in income stream over time away from oil and gas to more environmentally conscious renewable power or carbon sequestering projects. For the “High End” cap rate, I chose 6.50% (about 15.4x). I view this valuation as relatively conservative compared to a historical, 10 year, average price to free cash flow of 36.4x. The potential for Bitcoin mining influenced the optimistic outlook for TPL’s valuation. Since I started following TPL in 2019, the price of Bitcoin has increased roughly 1,020%. In the past five years, Bitcoin has increased almost 3,400%. For the “Low End” cap rate, I chose 10.0% (10x). This rate considers a scenario in which TPL is unable to successfully implement an income stream change and stays within the oil and gas space. The last time TPL saw a valuation close to my higher and lower end valuations was amid the COVID-19 pandemic in 2020, with the higher end number being reached towards the end of that year and the lower end number being reached at the deepest trough of the crash of global financial markets.