Environmentalists at the Gate – Brookfield Corporation (NYSE & TSX: BN) & Brookfield Renewable Partners (NYSE & TSX: BEP)

Abstract:

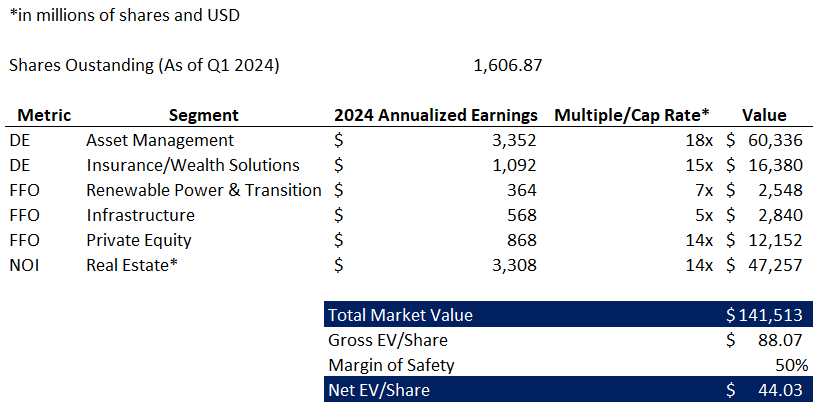

In 2023, the world spent $1.8tn on investments to transition the economy to net-zero carbon emissions. However, by 2030, this investment must reach $4.5tn per year to reach average global temperatures of 1.5 degrees Celsius above pre-Industrial Revolution levels. Governments and corporations must work to fill this deficit. One such company is Brookfield Corporation, a global alternative asset manager and investor. Among its private funds and permanent capital vehicles investing in areas such as private equity and real estate is Brookfield Renewable Partners (BEP), Brookfield’s publicly traded permanent capital vehicle to invest alongside their private funds in renewable energy assets and other transition investments. Given the complex investment structure of the renewable assets involving the Corporation, BEP, and other associated private funds carrying the Brookfield branding, we find that an investment in Brookfield Corporation allows investors a greater equity and income share of the renewable assets compared to investing in the renewable pure-play entity BEP. Given the role Brookfield will play in helping the world transition to a net-zero economy and the strength of their other business lines, we value Brookfield Corporation at $44.03/share.

Introduction:

Per Article 2 of the Paris Agreement, signing countries agree to aid in domestic and international efforts to bring average global climate temperatures to a maximum of 1.5 degrees Celsius above pre-Industrial Revolution era temperatures [1 & 2]. While very loosely legally binding [3], the threshold of 1.5 degrees is important in averting a kind of climate disaster unlike anything humankind has ever seen.

Where does this 1.5-degree figure come from? Per MIT News [4]:

The treaty did not define a particular preindustrial period, though scientists generally consider the years from 1850 to 1900 to be a reliable reference; this time predates humans’ use of fossil fuels and is also the earliest period when global observations of land and sea temperatures are available. During this period, the average global temperature, while swinging up and down in certain years, generally hovered around 13.5 degrees Celsius, or 56.3 degrees Fahrenheit.

The treaty was informed by a fact-finding report which concluded that, even global warming of 1.5 degrees Celsius above the preindustrial average, over an extended, decades-long period, would lead to high risks for “some regions and vulnerable ecosystems.” The recommendation then, was to set the 1.5 degrees Celsius limit as a “defense line” — if the world can keep below this line, it potentially could avoid the more extreme and irreversible climate effects that would occur with a 2 degrees Celsius increase, and for some places, an even smaller increase than that.

But, as many regions are experiencing today, keeping below the 1.5 line is no guarantee of avoiding extreme, global warming effects.

“There is nothing magical about the 1.5 number, other than that is an agreed aspirational target. Keeping at 1.4 is better than 1.5, and 1.3 is better than 1.4, and so on,” says Sergey Paltsev, deputy director of MIT’s Joint Program on the Science and Policy of Global Change. “The science does not tell us that if, for example, the temperature increase is 1.51 degrees Celsius, then it would definitely be the end of the world. Similarly, if the temperature would stay at 1.49 degrees increase, it does not mean that we will eliminate all impacts of climate change. What is known: The lower the target for an increase in temperature, the lower the risks of climate impacts.”

So, while the 1.5-degree target does not alleviate any of the problems the globe is currently experiencing or will experience, it does give some certainty to keeping much worse consequences at bay.

According to the International Energy Agency (IEA), global investment in the clean energy transition must reach $4.5 trillion (tn) per year by 2030 and $4.7tn per year by 2050 to bring average global temperatures to within the 1.5 degrees Celsius threshold [5 & 6]. Currently, the world is investing not even half of the target number; for 2023, global investment in the energy transition was just shy of $1.8tn [7].

If the world is to achieve its goal in limiting average temperatures to a maximum of 1.5 degrees Celsius above pre-Industrial Revolution temperatures, a great expansion in both governmental and corporate investment in the energy transition is needed.

Brookfield Corporation (Formerly Brookfield Asset Management | NYSE & TSX: BN):

Once a Canadian industrial conglomerate in the second half of the 20th century [8], Brookfield Corporation is now a global alternative asset manager and investor, with over $925 billion (bn) of institutional capital committed to Brookfield branded entities and funds [9]. Brookfield doesn’t just invest institutional capital, but also the capital on its own balance sheet, making its investment structure unique among more well-known managers, such as Blackstone, Kohlberg Kravis Roberts (KKR), and Texas Pacific Group (TPG). This investment structure can be thought of as a Berkshire Hathaway-Blackstone hybrid: investments are funded by large commitments from the corporation’s own balance sheet – like Berkshire – and by commitments from corporate sponsored funds with institutional capital – like Blackstone.

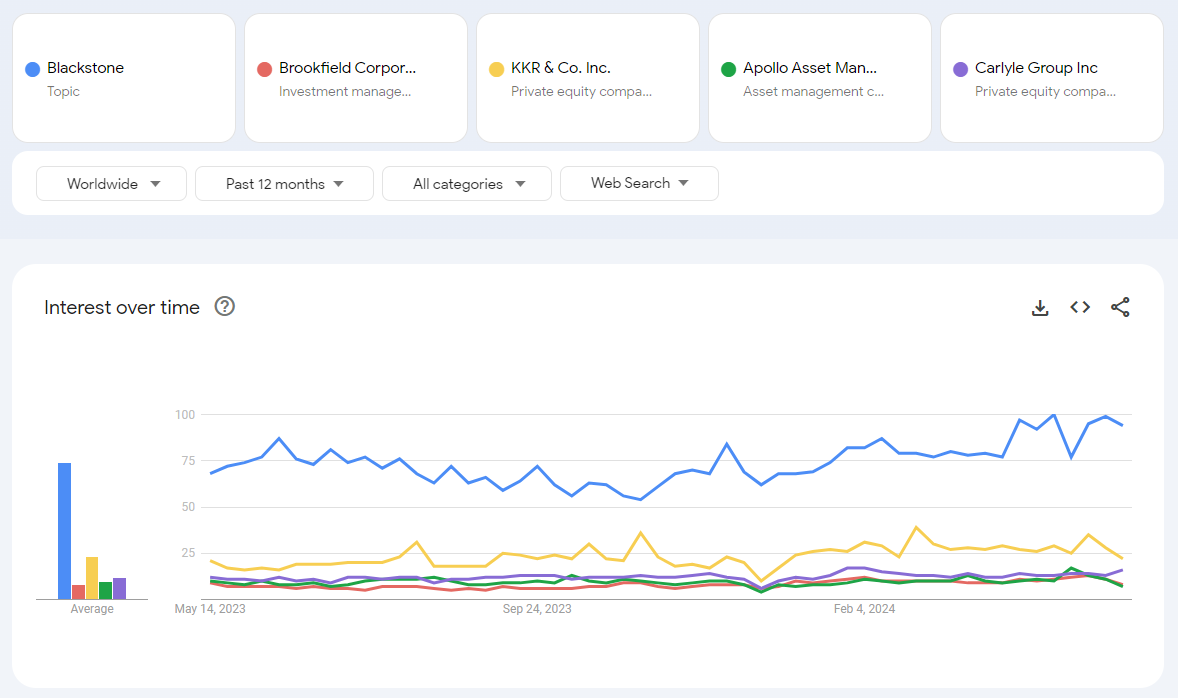

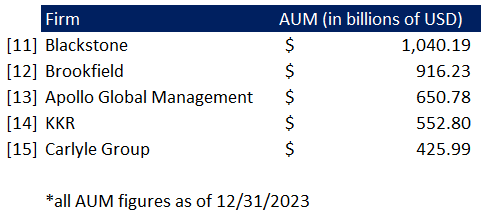

Among global private equity groups, Brookfield ranks among the highest in terms of assets under management (AUM), second only to Blackstone. However, still among this group, Brookfield is one of the most understated in terms of popularity [10].

Keeping in line with the Berkshire Hathaway-Blackstone hybrid business, Brookfield generates revenue through three avenues: asset management (the “Blackstone” side), “operating businesses” (the “Berkshire” side), and insurance (also like Berkshire).

Because it is not the focus of this report, I will briefly touch on the insurance segment before analyzing the asset management and operating business segments. Additionally, given the complex web of entities associated with the Brookfield name, “Brookfield,” “the Corporation,” and “Brookfield Corporation” are all used interchangeably. Any segment that is not the Corporation will be specified.

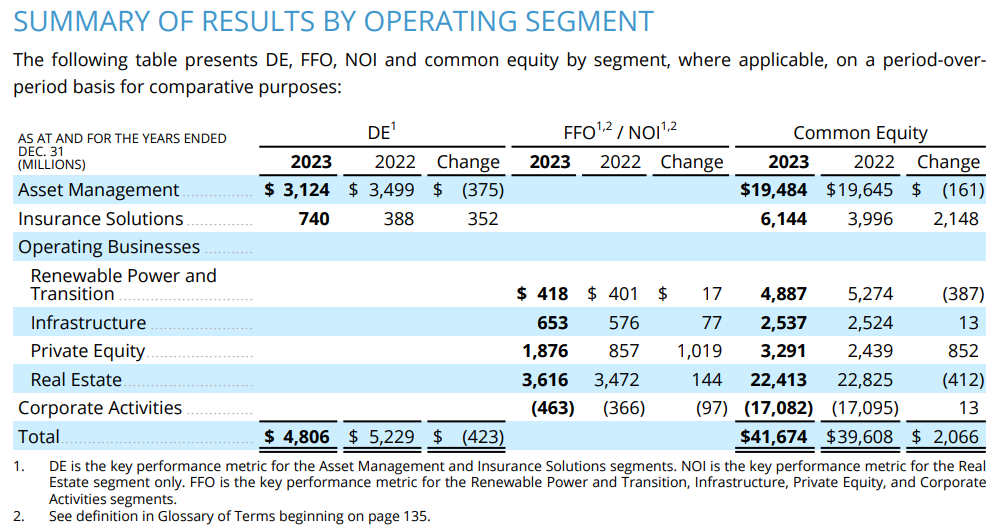

Source: Page 62 of Brookfield Corporation’s 2023 Annual Report [31]

Insurance:

Brookfield Reinsurance is Brookfield Corporation’s insurance segment. After completing its acquisition of American Equity Investment Life Holding Company (AEL), Brookfield Reinsurance now has over $100 billion in insurance assets under management [16]. The aim of the insurance division is to give another source of stable capital into the investment ecosystem of Brookfield, similar to Apollo Global Management’s merger with Athene to gain access to Athene’s annuity business [17]. As of 2023, Brookfield’s insurance business comprises $6.1bn of the Corporation’s $41.7bn in common equity.

Asset Management:

Brookfield Asset Management (BAM) is the “Blackstone” side of the Brookfield Corporation business. Historically, Brookfield Corporation was called Brookfield Asset Management before a 25% stake in the asset management segment was spun off, creating a “pure-play” and asset-light business. BAM is now the publicly traded entity containing the 25% equity interest in the asset management business and the original parent company, now called Brookfield Corporation, trades as “BN.”

BAM creates and invests institutional funds across a wide variety of “strategies,” including:

Renewable Power and Transition

Infrastructure

Real Estate

Private Equity

Credit (Oaktree Capital Group)

In each of these strategies, BAM hosts both long-term private fund products (the typical alternative investment firm product offering) and permanent capital vehicles/perpetual strategies. These permanent capital vehicles make up Brookfield Corporation’s “operating businesses,” which are either partly or completely owned by the Corporation but managed by BAM. BAM’s revenue is generated from a combination of asset management fees and carried interest allocations (performance fees) on its fee-bearing capital base of $457bn [18]. As of 2023, Brookfield’s common equity attributable to the asset management business was $19.5bn of a total of $41.7bn.

Operating Businesses – Brookfield Business Partners (NYSE & TSX: BBU):

Brookfield Business Partners is the permanent capital vehicle that co-invests in private equity transactions with BAM. BBU specializes in business services (financial, healthcare, technology, and real estate), industrial, and infrastructure (following a general specialty of Brookfield) acquisitions. As of 2023, Brookfield Business Partners represented $3.3bn of the Corporation’s $41.7bn in common equity [19 & 20]. Additionally, as of 2024, Brookfield’s economic interest in Brookfield Business Partners stood at 66% of outstanding BBU and BBUC (entity with shares convertible to BBU L.P. units) shares.

Operating Businesses – Brookfield Property Group:

Brookfield Property Group (BPG) is Brookfield’s permanent capital vehicle for global real estate investments, through direct investments or alongside private funds associated with Brookfield Asset Management. While BPG was once publicly traded like Brookfield’s other operating businesses, BPG was taken private in late 2021 for $6.5bn as the Corporation believed BPG shares were trading at a significant discount to net asset value [21]. Brookfield now owns 100% of BPG shares.

BPG primarily invests in existing commercial real estate assets but also has a residential development division, Brookfield Residential Properties, which conducts direct investments. BPG owns some of the most premier commercial properties across the globe, including the famous Canary Wharf financial district in London, and the Miami Design District, one of the most popular luxury retail complexes in Miami, Florida [22 & 23].

Miami Design District

As of 2023, Brookfield Property Group and other real estate holdings comprised $22.4bn of the Corporation’s $41.7bn total common equity, making the division Brookfield’s largest segment by equity.

Operating Businesses – Credit (Oaktree Capital Group):

In 2019, Brookfield acquired a 62% stake in Oaktree Capital Group, a leading global credit investment firm with $120bn in AUM at time of acquisition and $192bn in AUM today. The acquisition of Oaktree expanded Brookfield’s alternative investment products to include credit funds, an increasingly popular product today in a high interest rate environment and with banks skittish on lending. Within credit markets, Oaktree specializes in distressed debt securities and other high yield debt instruments. Brookfield’s common equity attributable to Oaktree is combined with its asset management segment, however Brookfield Asset Management has increased its stake in Oaktree from 62% to 68% [24, 25, 26, & 27].

Operating Businesses – Brookfield Infrastructure Partners (NYSE & TSX: BIP):

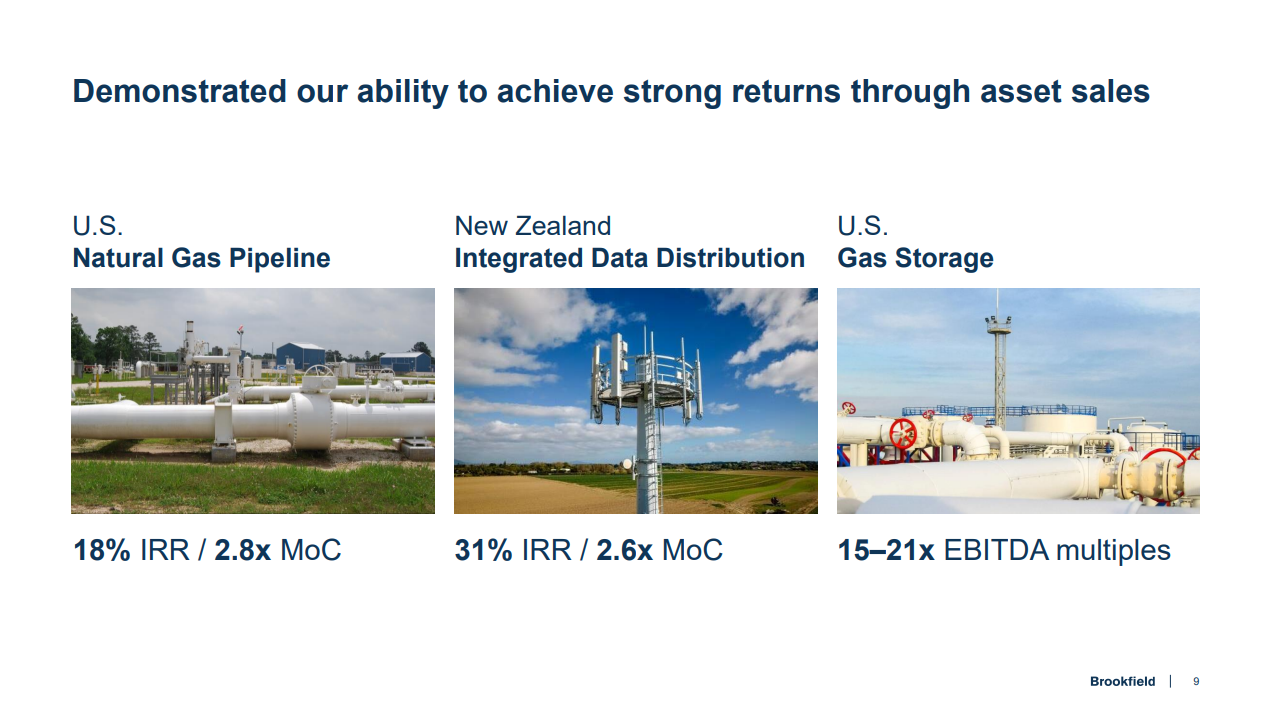

Brookfield’s growing specialty is in its infrastructure products, which span multiple “infrastructure” categories. BIP’s largest infrastructure investment is in transportation, including railroad tracks, toll roads, shipping vessel terminals, shipping containers, and liquified natural gas export facilities. Next is BIP’s utility holdings, which consist of energy transmission lines and residential and commercial energy distribution services. BIP’s midstream segment owns and operates natural gas transmission lines and storage facilities. Data infrastructure is BIP’s newest and currently smallest segment, and consists of data centers, fiber optic lines, and telecommunications towers. Additionally, BIP has entered the development of semiconductor foundries with a $15bn deal with Intel for two plants in Arizona, representing a 49% ownership stake [28 & 29]. Brookfield’s infrastructure segment makes up $2.5bn out of Brookfield’s total common equity of $41.7bn, and as of 2024, Brookfield’s economic interest in Brookfield Infrastructure Partners through BIP units and BIPC (convertible shares into BIP) shares was 26%.

Source: BIP 2023 Investor Day Presentation [30]

Operating Businesses - Brookfield Renewable Partners (NYSE & TSX: BEP):

While clean energy assets might technically be infrastructure assets, Brookfield separated its permanent capital vehicles into one for general infrastructure investments (BIP) and one specifically for renewable energy infrastructure investments, Brookfield Renewable Partners (BEP).

Brookfield’s renewable energy division began with its hydropower assets in the 1980s before concerns about climate change were as prevalent as today [32]. Brookfield continued to build upon its hydropower business in the late 1990s [8] and later would expand into other renewable energy assets, including solar and wind. Beyond renewable assets, BEP has expanded its investment landscape to include what it calls “distributed energy & storage,” which includes investments in “…emerging technologies that require capital to scale…” This division can be seen almost as a late-stage venture capital arm of BEP. While distributed energy & storage only made up 5% of BEP’s funds from operations (FFO), BEP “[has] a visible pipeline to grow this segment which complements [its] renewable power business.”

Brookfield Renewable’s business model mirrors that of a traditional private equity deal, except with renewable assets [33]:

Our business model is to utilize our global reach and experience to acquire and develop high quality clean energy and sustainable solutions assets below intrinsic value, finance them on a long-term, low-risk and investment grade basis through a conservative financing strategy and then optimize cash flows by applying our operating expertise to enhance value or bring these assets into production generating incremental cash flows for our business.

Through this model, Brookfield acquires and develops renewable assets either through company acquisitions [34] or asset specific acquisitions [35]. In recent years, however, most renewable asset acquisitions have been through the acquisition of companies with a portfolio of renewable assets.

As of the first quarter of 2024, BEP’s renewable power portfolio had roughly 32.5 gigawatts (GW) of operating capacity and a development pipeline of 157 GW. Proportionally to the Brookfield Renewable Partners entity, 50% of FFO came from hydroelectric operations; 22% from wind assets; 14% from utility solar; 8% from distributed energy & storage; and 5% from “sustainable solutions.” Geographically, 60% of FFO was generated in North America; 23% in Europe; 15% in South America; and 2% in Asia [36].

Looking broadly at Brookfield Corporation and their renewable assets, including private funds with stakes in renewable assets and BEP’s stake in the assets, it is likely for BEP unitholders specifically that their crown jewel assets are the hydropower plants. This is probable for two reasons: (1) the acquisition of hydroelectric plants in the 1980s began prior to Brookfield’s introduction of private funds for its new asset management business in 2001, and more importantly (2) the useful life for a hydroelectric plant is much longer than the average lifespan of a private fund [37 & 31]. Given that BEP is a permanent capital entity, of which 46% [38] is owned by Brookfield Corporation, owning the very long-duration hydropower assets completely or almost completely by a permanent capital vehicle is logical compared to splitting the Brookfield branded ownership between private funds and BEP. This does not necessarily mean that the hydropower assets can’t have non-controlling interests outside of Brookfield, however as you will see in a case study of certain Brookfield transactions through BEP, ownership of a Brookfield branded renewable asset can be split between the permanent capital vehicle and private funds from BAM.

Brookfield Global Transition Fund I & II:

In the middle of 2022, Brookfield (then still known as Brookfield Asset Management) closed its first private fund dedicated to just investing in deals moving the world to net-zero carbon emissions: the Brookfield Global Transition Fund I, or BGTF I. At closing, the fund had $15bn in total limited partner (LP) commitments, including investments within the fund and capital that would be invested alongside fund investments (to avoid fees). There are over 100 LPs within BGTF I and “the final fund size was oversubscribed,” highlighting investor demand for assets aiding in the net-zero transition [46]. In recent deals, Brookfield Renewable Partners – the permanent capital vehicle – would make investments alongside an investment from the BGTF, such as in the first two case studies below.

Earlier this year, Brookfield Asset Management (now separated) announced that in the first closing of the second transition fund, BGTF II, LP commitments totaled $10bn. BGTF II follows the same investment strategy as the inaugural fund but intends to be even bigger given that BGTF I is “now substantially deployed or committed.” BAM targets a final closing of the second fund for the third quarter of 2024 [47].

Catalytic Transition Fund:

At the COP28 climate conference in late 2023, Brookfield Asset Management announced a partnership with ALTERRA to create the Catalytic Transition Fund (CTF). (Also at this event ALTERRA announced a $2bn commitment to BGTF II.) Alterra is the “newly established climate focused investment manager” created by global investment manager Lunate, which is headquartered in Abu Dhabi. Unlike the Brookfield Global Transition Fund(s), CTF is specifically focused on transition investments in emerging and developing market economies. Emerging and developing markets have been underinvested in for the net-zero transition, and CTF marks an important step Brookfield and other global investment managers have made in servicing this investment deficit. CTF will be managed by BAM, and ALTERRA has committed to investing up to $1bn in the new fund. BAM has committed to contributing at least 10% of the fund’s capital. Additionally, Temasek – the sovereign wealth fund for the government of Singapore – and CDPQ – the public employees’ pension fund for Quebec, Canada – have “expressed interest in contributing commercial capital” to the CTF [48].

Case Study 1 – Origin Energy:

While I must preface by mentioning that the acquisition proposal from Brookfield would not end up achieving the required Origin Energy shareholder support for completion, this deal is a good example of the type Brookfield attempts to accomplish. This is not to say that Origin shareholders did not widely support the acquisition. Of the 78% of shareholder’s present, 69% support the acquisition, however this did not meet the required majority for the acquisition to be approved [39]. For the deal to pass, 75% of shareholders needed to support the acquisition [40].

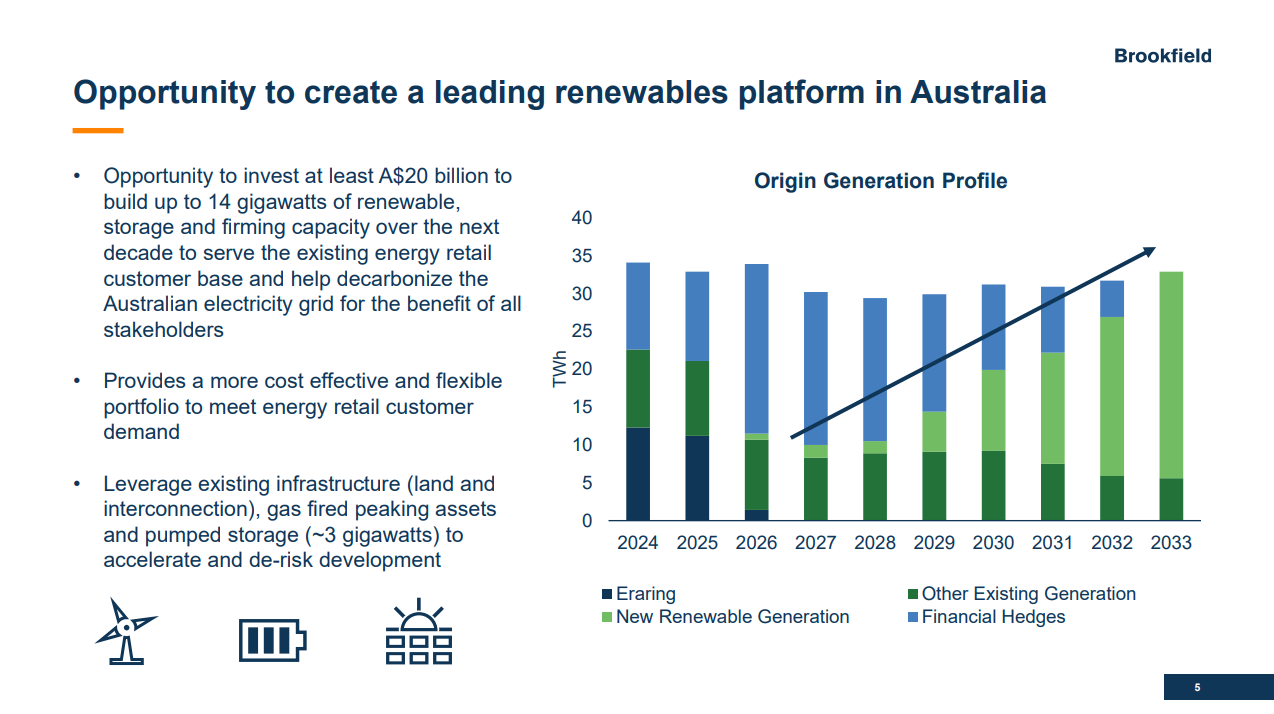

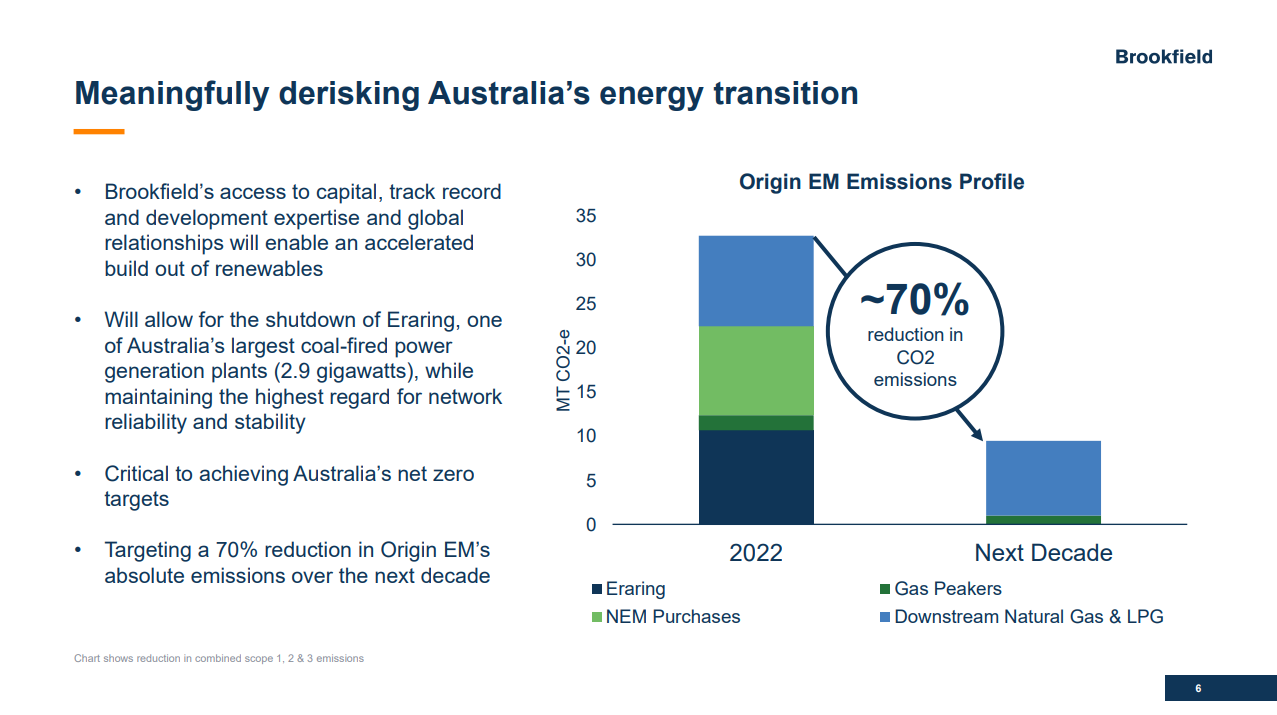

Origin Energy is “Australia’s largest integrated power generation and energy retailer business.” At the time of the announcement for Brookfield Renewable and its partners to acquire Origin, the company had 4.5 million customers demanding 33 terawatt hours (TWH | 1,000 GW = 1 TW) of electricity annually and a 24% market share of the National Energy Market in Australia.

Origin primarily generates electricity from coal and gas power plants. Of the 2023 total owned and contracted electricity generation of 7.8 GW, 6.3GW came from coal and gas power and just 1.5 came from renewable power purchase agreements [42].

Brookfield Renewable’s goal was to acquire Origin’s energy markets (EM) division and to invest a further A$20bn ($13.2bn) with its institutional partners to transition the EM division’s generation to renewable power and away from coal and gas. Since the energy market business generates cash flow as a utility provider, the earnings would have been generated through selling renewable electricity to Origin’s 4.5 million customers rather than coal and gas energy.

Source: Page 5 of Origin Transaction Summary Presentation [41]

Source: Page 6 of Origin Transaction Summary Presentation [41]

Since Origin also had an integrated gas business with a stake in the Australia Pacific LNG project, which Brookfield did not want, the complete takeover of Origin Energy included the partner MidOcean Energy (a company formed by EIG Global Energy Partners) to take control of the gas business. This meant that the consortium to acquire Origin Energy would have split the company into an energy markets company owned by Brookfield and an LNG company owned by EIG [43].

The proposed acquisition would have placed an enterprise value on Origin Energy of A$18.7bn ($12.3bn), or A$8.91 ($5.88) per share. This represented a 53.4% premium to Origin’s share price before the acquisition was announced. Brookfield and EIG would then revise their offering to A$9.39 ($6.20) per share, or roughly an enterprise value of A$19.1bn ($12.8bn). Brookfield also proposed to pay A$12.3bn ($8.1bn) for the energy markets business if the other offering including EIG and their purchase of the LNG business failed, but this was not approved by Origin’s board. While it is publicly unknown how much Brookfield would have paid for the EM business under the original offer of A$8.91 per share, it is known that Brookfield Renewable Partners would have contributed $750 million (mn), or roughly A$1.1bn. Brookfield also intended to pursue the transaction through the Brookfield Global Transition Fund I [44 & 45].

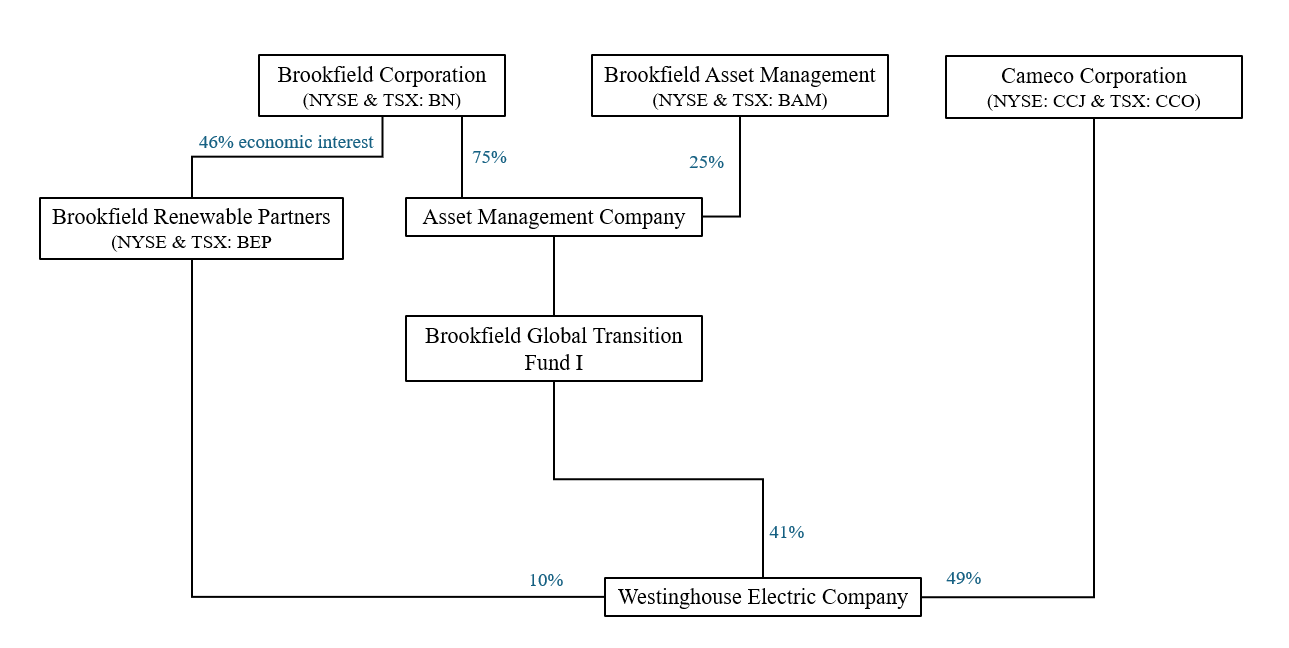

Case Study 2 – Westinghouse Electric Company:

Unlike the acquisition of Origin Energy, Brookfield Renewable Partners’ and Cameco Corporation’s (see our report on Cameco) takeover of Westinghouse Electric Company did go through, likely helped by the fact that the consortium of BEP and Cameco bought Westinghouse from Brookfield Business Partners. (On BBU’s side, the acquisition of Westinghouse out of bankruptcy from Toshiba [49] and the disposition of Westinghouse to BEP and Cameco proved to be an incredible investment. “When combined with distributions received to date, [BBU’s] expected proceeds will equate to approximately 6 times its invested capital, a 60% IRR and $4.5 billion of total profit.” BBU’s 44% share of the distribution equated to $1.8bn in proceeds [50].)

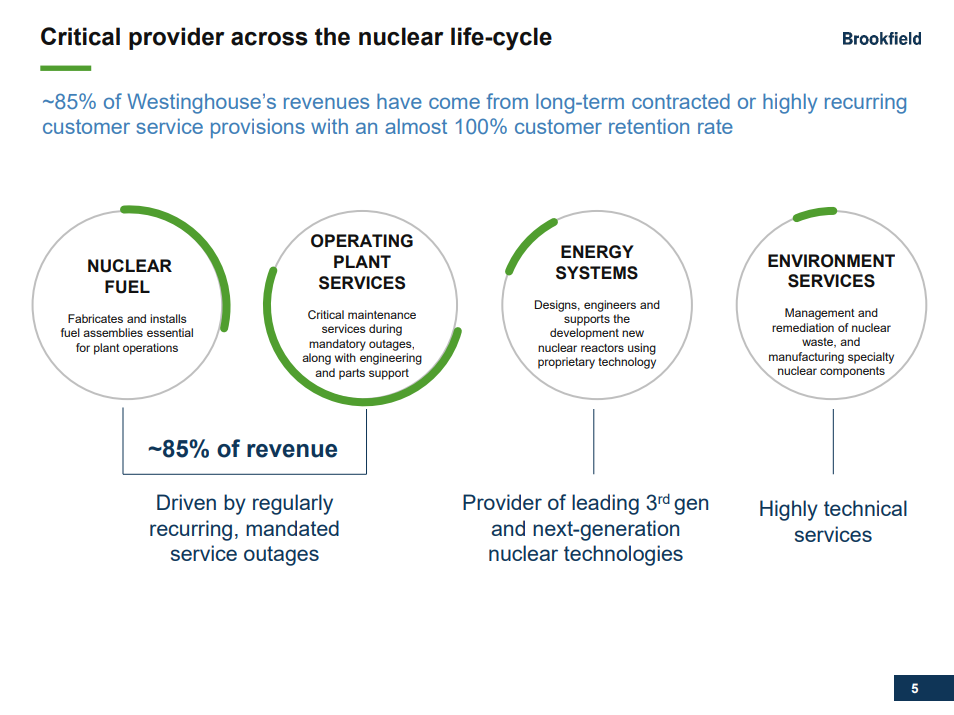

Westinghouse Electric Company is “one of the world’s largest nuclear services” companies. Its business spans 4 primary lines:

Source: Page 5 of BEP Westinghouse Transaction Summary [52]

In addition to its core business of fabricating and installing nuclear fuel assemblies and maintaining nuclear power plants, Westinghouse’s Energy Systems shows multiple avenues for growth. While Westinghouse already offers the AP1000 pressurized water reactor power plant design, a 1,000 MW (or 1GW) power plant, the Energy Systems division is developing the AP300, a 300 MW (0.3 GW) small modular reactor (SMR) based on the design of its successful AP1000. SMRs are critical to aiding in the net-zero transition. Because nuclear energy provides a carbon-free and energy dense power source, the primary benefit of SMRs requiring much lower capital commitments than full size reactors mean they can be more readily deployed. Westinghouse is also developing the eVinci microreactor, which acts almost like a large nuclear-powered generator. Only meant to supply around 5 MW, the eVinci reactor is meant to serve as a power source for small projects, like an industrial warehouse, and can operate for 8 years before refueling is required [53, 54, & 55].

Source: Cameco’s Westinghouse Acquisition Press Release [53]

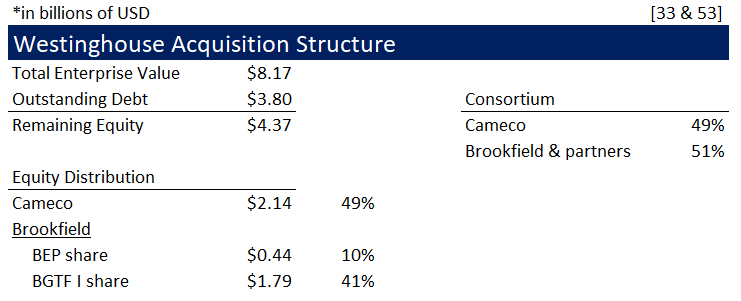

The proposed transaction of Westinghouse was for a total enterprise value of $7.9bn. Because Cameco and BEP were purchasing from BBU, so within the “Brookfield” umbrella, Westinghouse’s existing debt was allowed to stay in place leaving $4.5bn in equity cost to be split 51% to Brookfield and 49% to Cameco. Brookfield and its partners’ dollar share of the equity equated to $2.3bn and Cameco’s share to $2.2bn. Brookfield Renewable Partners expected to invest $750mn for a 17% interest in Westinghouse, and the remaining 34% of Brookfield’s stake coming from the BGTF I [51].

At the actual close of the transaction, the final enterprise value was $8.2bn to adjust for working capital balances and Westinghouse had $3.8bn in outstanding debt [53]. Below is a rough model of the end transaction. From Brookfield Renewable Partners’ 2023 Annual Report, the final equity cost of Westinghouse was $4.37bn. The sum of the equity cost and the reported debt in the Cameco press release [53] equated to $8.17bn in the model, which rounds to the $8.2bn figure stated in the press release.

Case Study 3 – Microsoft Partnership:

On May 1st, 2024, Microsoft, Brookfield Asset Management, and Brookfield Renewable announced the largest power purchase agreement (PPA) ever signed. Before we get into the deal with Microsoft, I will first go over what a PPA is, since it is a key component of how Brookfield’s renewable division generates cash.

A power purchase agreement is a contract where a developer (in this case, Brookfield) will “install, own, and operate” an energy asset on or near a customer’s property (in this case, Microsoft). This customer, often referred to as an offtaker, will purchase power from the developer/owner at a predetermined rate and for a set period. This contract allows developers like Brookfield to lock in a set price and customer for their energy. Brookfield also includes inflation adjustments in their PPAs, since PPAs act almost like a fixed income source which become less valuable with inflation. Offsite PPAs accomplish a similar task except the developer does not have to construct the energy asset on the offtaker’s land [57].

Source: Department of Energy [57]

PPAs are a critical part of Brookfield Renewable’s business model since a known customer and cash flow source, among other things like an acceptable financing package, are a key consideration when BEP evaluates a possible renewable development and/or acquisition.

With Microsoft, Brookfield signed a five-year PPA to develop over 10.5 GW of renewable energy assets. This PPA is “almost eight times larger than the largest single corporate PPA ever signed.” Already, Brookfield and Microsoft have a 1 GW contract, however with this new agreement comes a much larger collaboration that could expand to other regions with large Microsoft operations. This agreement is for the development of renewable assets in the US and Europe between 2026 and 2030. With Microsoft’s goal of consuming 100% clean electricity 24/7, and the increasing demand for power from the company’s cloud storage and artificial intelligence operations, this new agreement provides a way for Microsoft to both work towards its constant clean energy consumption goal and be able to feed into the growing demand of its data centers and the artificial intelligence boom [56].

Risks – Brookfield Renewable:

As Beskar has seen from recent troubles with Orsted, renewable power businesses can run into trouble with the way their energy revenue is structured and how their assets are financed. While a PPA provides a certainty of a power price and therefore a fixed income, not including an inflation adjustment on that price of power can prove to be problematic. More problems arise if that asset with no inflation adjustment on its PPA is financed using floating rate debt. This can lead to a high probability of the asset becoming bankrupt as interest payments could exceed the fixed income.

Brookfield tries to mitigate each of these risks. The majority of the PPAs and other contracted generation agreements have inflation escalation clauses, eliminating some risk associated with the devaluation of the fixed income. For financing these assets, Brookfield aims to “raise the majority of [their] debt in the form of asset-specific, non-recourse borrowings” and “approximately 91% of [their] borrowings are non-recourse.” About 90% of financings are fixed rate with a weighted average interest rate of 5.4% (highest rate at 6.6%) and a term of 12 years.

Another trouble seen with Osred that could be a risk to Brookfield Renewable is the failure for some assets in the development pipeline to reach final investment decision (FID). A failure for a significant portion of Brookfield’s 155.4 MW development pipeline to reach FID and begin undergoing construction could prove problematic for Brookfield Renewable’s revenue and FFO growth. Along with a failure to achieve FID could come large impairment costs, which proved to be a strong catalyst for Orsted’s recent large equity decline.

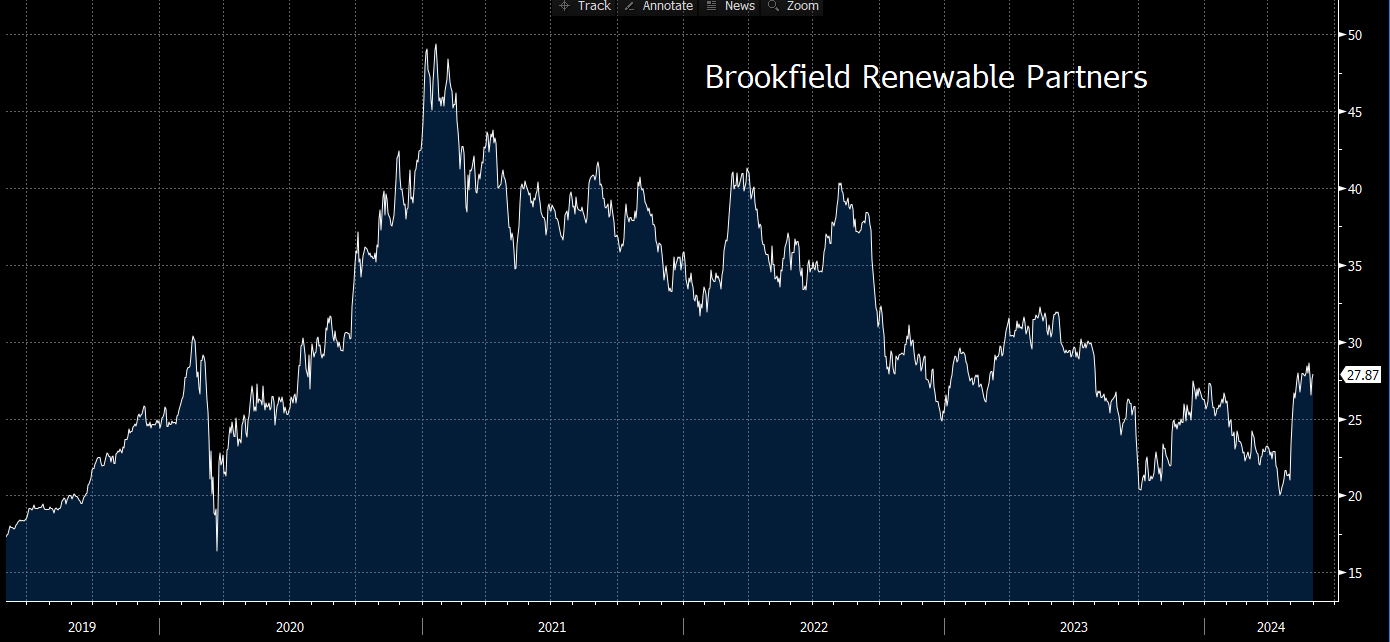

Brookfield Renewable Partners – Financial Overview:

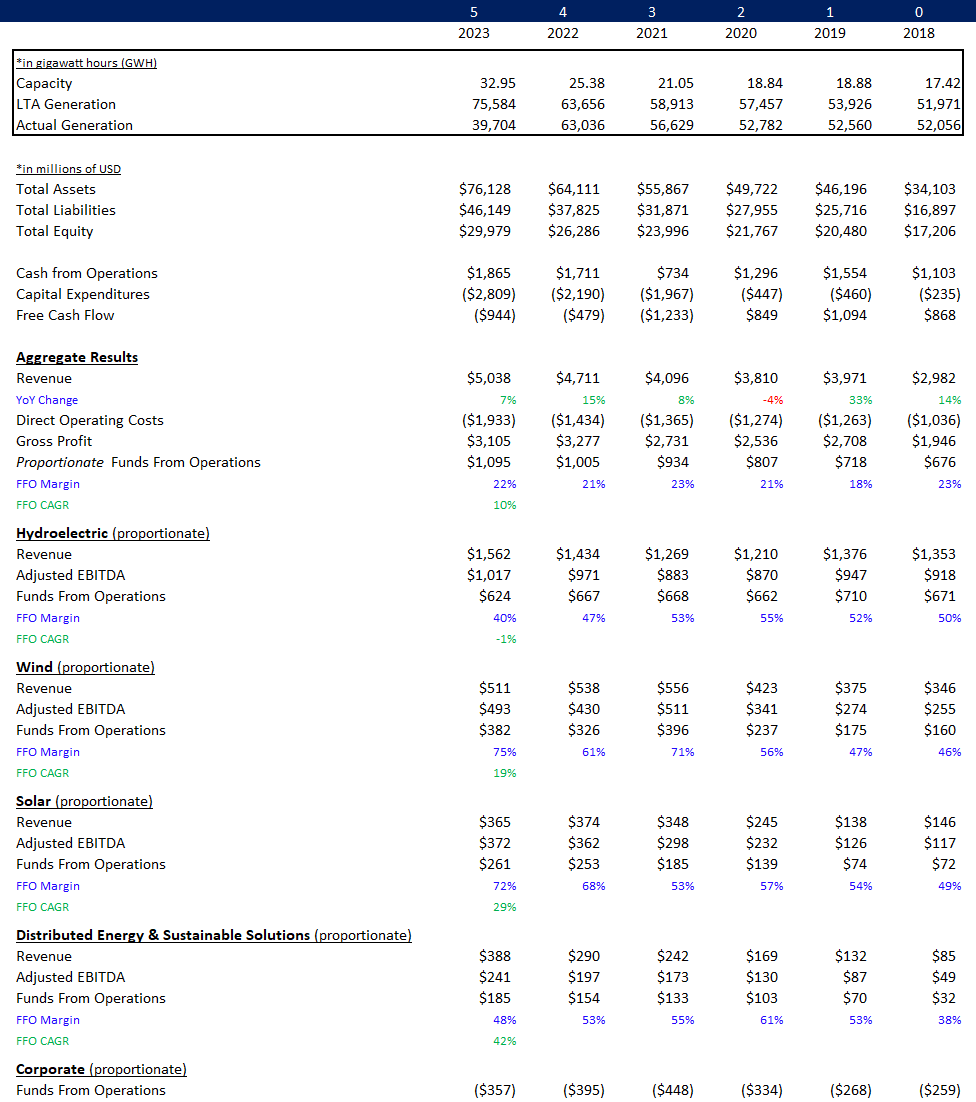

[58]

Brookfield Corporation – Financial Overview:

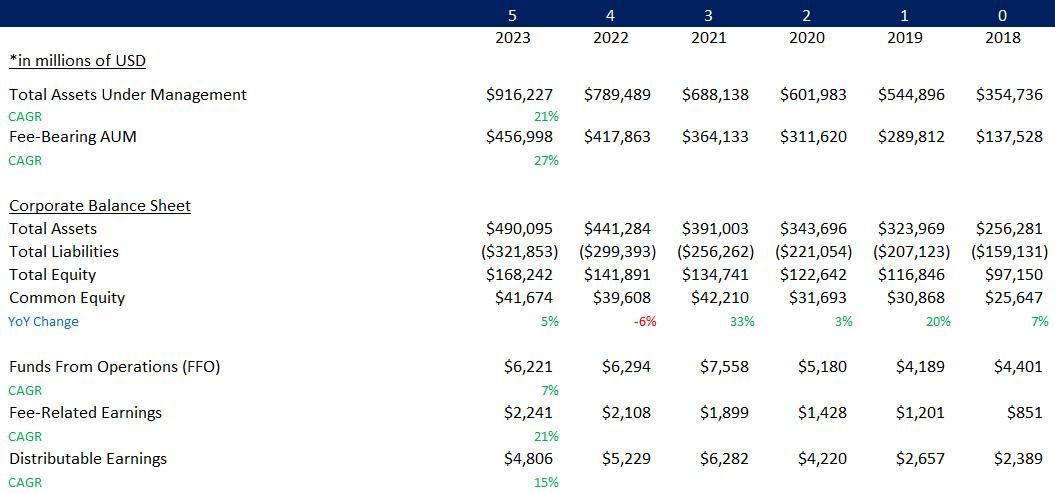

[59]

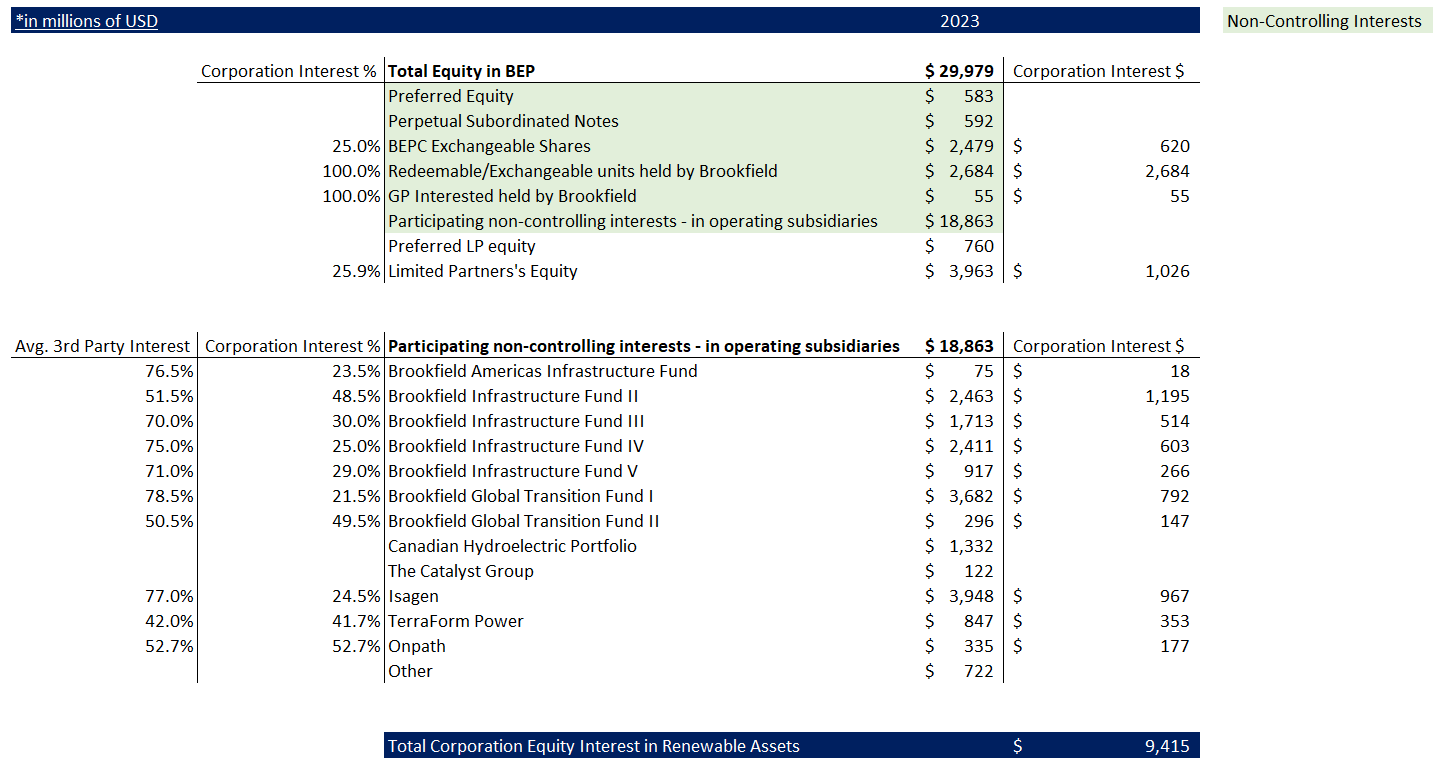

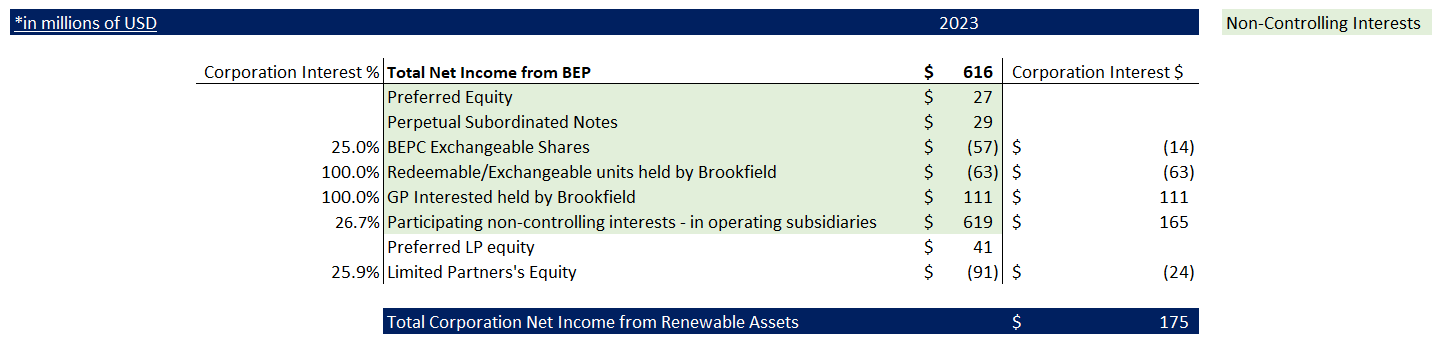

Equity Distribution of Renewable Assets:

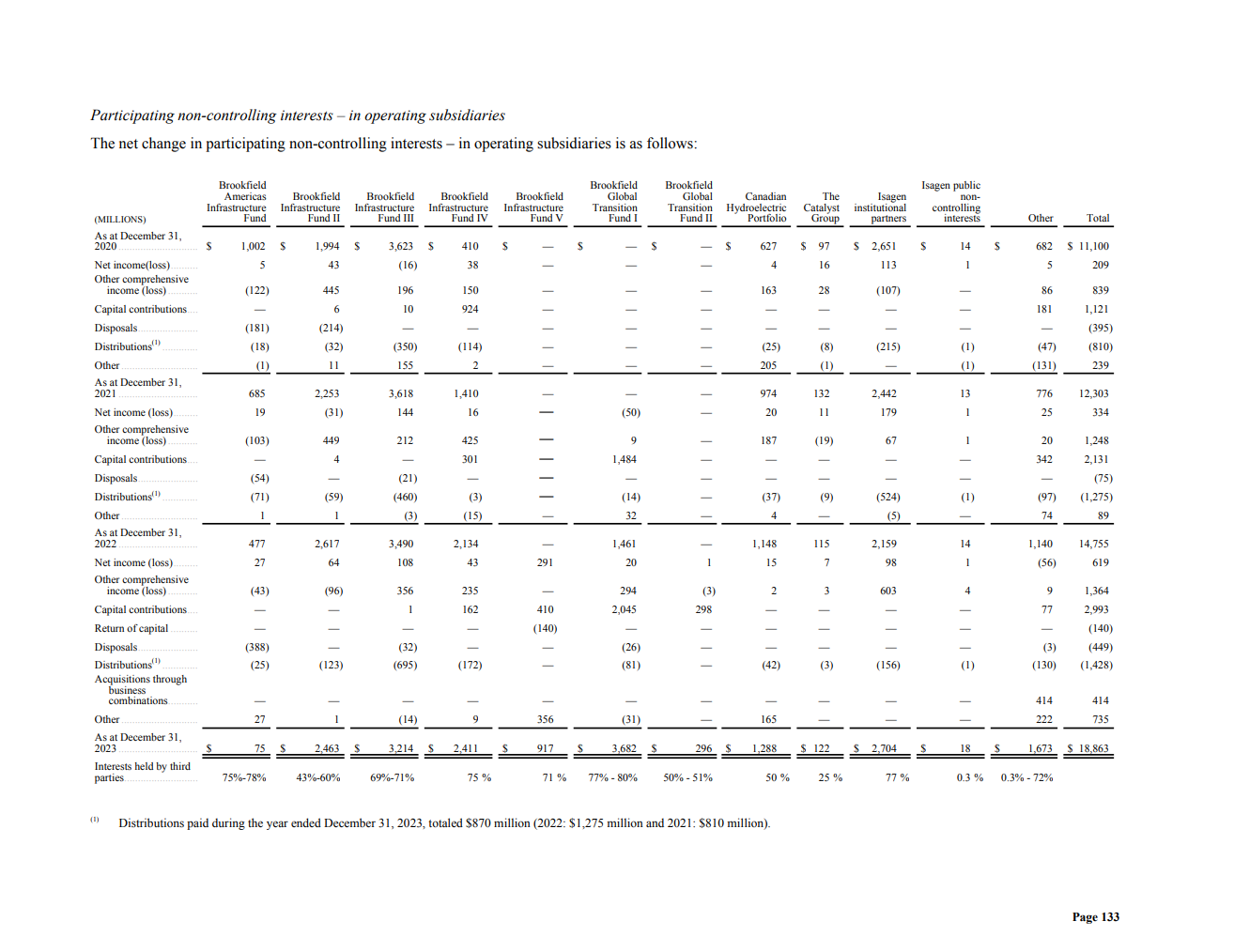

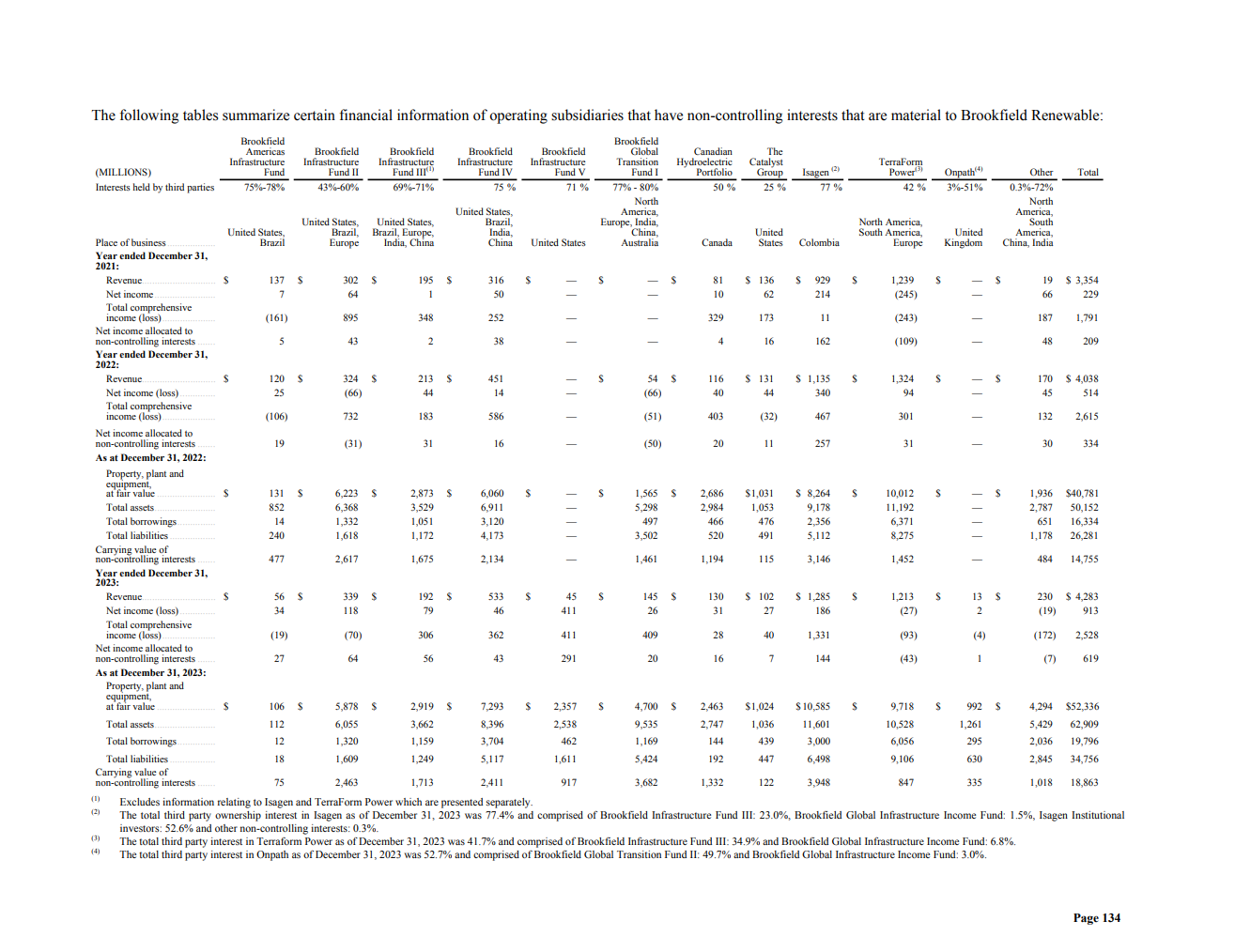

Given the large web of “Brookfield” branded entities all with stakes in the renewable assets (this is also true of other assets Brookfield invests in such as infrastructure), it becomes very complex to understand which entity owns the greatest percentage of a renewable asset and which entity has seniority in earnings. For example, while Brookfield Renewable Partners reported their fiscal 2023 net income to be $616mn, net income directly attributable to BEP limited partners (unitholders) was -$91mn. However, the “participating non-controlling interests” of BEP earned $619mn in net income. These “participating non-controlling interests” are predominantly made up of the privately managed Brookfield Asset Management funds, including but not limited to, Brookfield Americas Infrastructure Fund, Brookfield Infrastructure Fund II, Brookfield Infrastructure Fund III, Brookfield Infrastructure Fund IV, Brookfield Infrastructure Fund V, Brookfield Global Transition Fund I, and Brookfield Global Transition Fund II. Additionally, other non-controlling interests like Isagen and TerraForm Power had its third-party ownership made up of varying Brookfield private funds.

[33]

To make sense of how all these entities work together on a single deal (and the general structure of “Brookfield”), I will examine the ownership structure of Westinghouse through a rough flow chart:

To make the Corporation’s interest in BEP even more complex, Brookfield has a 1% general partnership interest [33 & 60] that entitles the Corporation to a promote structure on BEP’s distributions. As of the first quarter of 2024, the Corporation’s promote agreement with BEP was structured such that if distributions to limited partners exceeded $0.20/unit/quarter, Brookfield receives 15% of distributions above the $0.20/unit. Further, if distributions exceeded $0.2253/unit/quarter, the rate jumps to 25% of distributions above this level. At the end of 2023, Brookfield Corporation earned $111mn in incentive distributions.

As a potential investor in Brookfield Corporation and Brookfield Renewable Partners – both entities with real equity in the renewable energy assets – I must now disentangle the complexity brought up in the beginning of this section: who owns what and how much do they earn. I will first attempt to create a more thorough ownership structure of the renewable assets and then dissect how much Brookfield Corporation and Brookfield Renewable Partners earn from the assets.

Based off our rough estimate, in aggregate, Brookfield Corporation has a greater share of equity in the renewable energy assets listed on the BEP balance sheet and earns a greater share of the consolidated net income than just the BEP limited partner’s equity. Therefore, I would prefer to own equity in the Corporation than just to the pure-play equity in the BEP units and will conclude this research with a valuation of Brookfield Corporation shares on a sum-of-the-parts basis.

Valuation – Brookfield Corporation:

Sources:

[1] https://unfccc.int/process-and-meetings/the-paris-agreement

[2] https://unfccc.int/sites/default/files/english_paris_agreement.pdf

[4] https://news.mit.edu/2023/explained-climate-benchmark-rising-temperatures-0827

[8] https://history.brookfield.com/history/

[9] https://www.brookfield.com/about-us/who-we-are

[12] https://www.brookfield.com/sites/default/files/2024-03/2023_BN_Annual_Report_0.pdf

[13] https://ir.apollo.com/sec-filings/content/0001858681-24-000031/apo-20231231.htm

[15] https://ir.carlyle.com/static-files/fbcc9357-1d9e-4f4b-bfef-32d066a6f043

[16] https://bnre.brookfield.com/press-releases/brookfield-reinsurance-completes-acquisition-ael

[19] https://bbu.brookfield.com/sites/bbu-brookfield-ir/files/2024-03/bbp-q4-annual-report-cover.pdf

[20] https://www.brookfield.com/our-businesses/private-equity

[23] https://www.brookfieldproperties.com/en/our-properties/miami-design-district-371/#location

[24] https://bam.brookfield.com/sites/brookfield-ir/files/bam/oaktree-investor-presentation.pdf

[25] https://www.oaktreecapital.com/about

[28] https://bip.brookfield.com/sites/bip-brookfield-ir/files/Brookfield-BIP-IR-V2/bip-2023-20-f.pdf

[31] https://www.brookfield.com/sites/default/files/2024-03/2023_BN_Annual_Report_0.pdf

[32] https://history.brookfield.com/renewable-power/

[34] https://bep.brookfield.com/press-releases/bep/brookfield-renewable-acquire-duke-energy-renewables

[39] https://www.originenergy.com.au/about/investors-media/results-of-the-scheme-meeting/

[40] https://www.reuters.com/business/energy/australiansuper-increases-stake-origin-energy-2023-09-21/

[42] https://www.originenergy.com.au/wp-content/uploads/54/Origin_2023_Annual_Report.pdf

[49] https://www.ft.com/content/74afda84-f174-11e7-b220-857e26d1aca4

[55] https://www.westinghousenuclear.com/energy-systems/evinci-microreactor/

[57] https://betterbuildingssolutioncenter.energy.gov/financing-navigator/option/power-purchase-agreement

[58] https://bep.brookfield.com/bep/reports-filings/annual-reports

[59] https://bn.brookfield.com/reports-filings/annual-reports

[60] https://bep.brookfield.com/sites/bep-brookfield-ir/files/2024-02/bep-2023-annual-20-f.pdf